Sayer introduces business incentive bill he says is a ‘game-changer’ for economic development in state

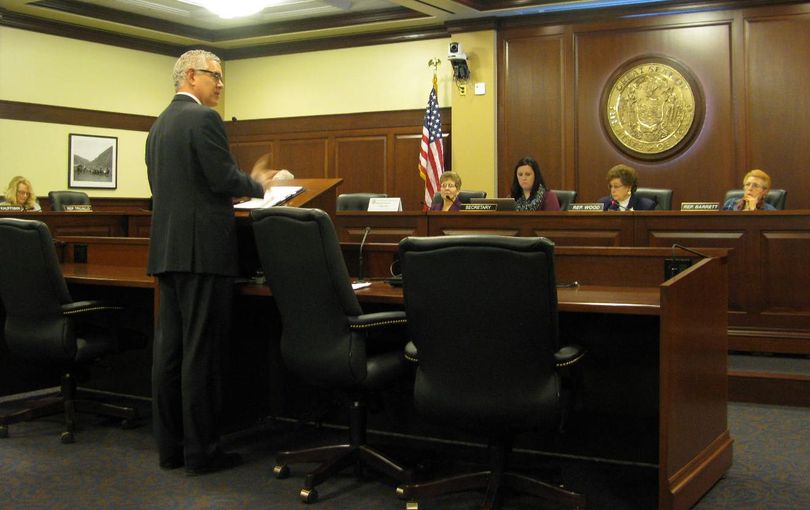

Idaho state Commerce Director Jeff Sayer introduce new business incentive legislation this morning that he called a “game-changer” for economic development in Idaho. Patterned after a Utah law, the bill would allow the state to consider rebating up to 30 percent of a company’s corporate income tax, sales tax and payroll tax if it brings in certain numbers of high-paying new jobs. The credit would be available to existing as well as new companies, and projects would qualify only if they bring a minimum of 20 new jobs to a rural area or 50 to an urban area; and if the new jobs pay higher than the typical wage in the county.

The House Revenue & Taxation Committee voted unanimously to introduce the bill, clearing the way for a full hearing. Sayer said he’s not requesting any funding for the bill, because it would be “self-funding” – the taxes would be rebated only if they’re first generated and paid in to the state. He estimated that if companies applied next year, the foregone taxes wouldn’t exceed $3 million.

Sayer said the new incentive would work for any industry, unlike Idaho’s current incentives, which focus on paying for infrastructure like roads and sewer lines. That would allow Idaho to entice “professional service firms, software firms, tech firms – companies that traditionally don’t need infrastructure, he said. “By having a tool like this, Idaho will be able to be at the table and be recognized in deals we’re not even being considered in right now.” Click below for a full report from AP reporter John Miller.

Idaho Commerce director pitches new tax incentive

By JOHN MILLER, Associated Press

BOISE, Idaho (AP) — Idaho's lackluster tax incentives make it flyover country for many companies looking to relocate or expand. That's the verdict of Department of Commerce Director Jeff Sayer, the state's top economic development promoter, who pitched a plan Friday he believes would help change that.

The measure, modeled after one in Utah and supported by Gov. C.L. "Butch" Otter, is Sayer's "highest priority" for the 2014 Legislature, he told the House Revenue and Taxation Committee.

His proposition is this: What if Idaho allows companies that hire new, well-paid employees to recoup up to 30 percent of their income, sales and payroll taxes after they've proven to have met expansion promises? That way, Sayer says, the state would protect itself from companies that don't follow through by declining to distribute the money.

"We literally will be putting the responsibility on the shoulders of the companies to determine their own success," Sayer said. "We feel like we will be out in front and competitive."

The House tax panel introduced the measure, for debate in coming weeks.

According to the proposal, companies would have to create jobs and pay income, sales and payroll taxes before ever getting a penny back from Idaho's government.

Beforehand, they'd work with the Department of Commerce, as well as the seven-member Idaho Economic Advisory Council, to negotiate the level of tax credit — ranging from 1 percent to 30 percent. They'd also hash out the duration of the deal — up to 15 years — along with the terms to be met in order to get their tax credit.

Companies in rural areas would have to create at least 20 new jobs, while companies in urban areas would have to create 50 jobs, all of which pay more than the average in the county where those jobs are located.

Another provision requires local communities to demonstrate they support the projects by offering a match.

That's something Commerce spokeswoman Megan Ronk says could range from helping dig a ditch for utilities, if that's all a community has to offer, to more significant monetary help for projects in more urban areas.

"There's a whole range of matches that could be eligible," Ronk said.

This "Tax Reimbursement Incentive" is similar to a five-year-old program from Utah.

There, the incentive has been credited with helping lure companies including a German prosthetics maker, Ottobock HealthCare, to create 80 jobs in the state around Salt Lake City.

Sayer, a former Utah resident, says he doesn't mind cribbing from Idaho's southerly neighbor, if it helps create jobs. "They've proven it works," he said.

His proposal includes some differences with Utah's program, however.

For instance, when that state's Legislature created the program in 2009, it excluded retail companies. Idaho, by contrast, will hold out this tax carrot to retail stores.

Sayer says he's optimistic the plan will prevent companies that churn out low-paying jobs from getting the benefit.

"At the end of the day, we wanted this to be open," Sayer said. "By having those minimum requirements built into the bill, it's going to be self-selecting,"

Copyright 2014 The Associated Press