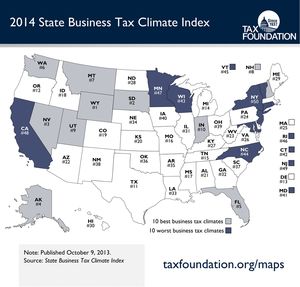

WA No. 6 for good biz tax structure

Washington state has the sixth best structure for business taxes in the country, the Tax Foundation said.

In its annual report on state tax "climates", the foundation gave Washington high marks...as it usually does.

This may surprise people who have heard the business community complain about the state's tax structure or notice that pro-business groups often give campaign money to candidates who vow to change it. . .

The Tax Foundation is not some commie-pinko liberal apologist organization. But the state's high ranking is due, in large part, to two things:

1. The state has no personal income tax.

2. The state has no corporate or business income tax.

That gives Washington a big boost when the foundation compares the relative tax structures of the states. Yes, the sales tax is among the highest in the country. Yes, there's a gross receipts tax on businesses. But some other taxes are mid-range, so Washington wound up at No. 6 this year, as it did in 2013 and 2012.

If you want to read the full study, click here.