House budget would add $1.4 billion for schools, require capital gains tax

Updated at 1:25 p.m.

OLYMPIA -- Washington would spend an extra $1.4 billion on public schools, increase money for mental health programs and give raises to teachers and state workers under a two-year budget unveiled this morning by House Democrats.

To help pay for this $38.8 billion spending plan, they are proposing several tax increases, including a capital gains tax on investment gains of more than $25,000 for an individual or $50,000 for a couple; a bump in the business and occupation tax rate on services and closing seven tax breaks that have survived previous attempts at elimination.

The formal release of a budget by majority Democrats in the House begins the complicated back-and-forth between the two chambers controlled by different parties which may or may not be finished by April 26, the final day of the regular session. It will be the subject of a hearing on Monday in the House Appropriations Committee, and could come to a vote of the full House as early as Tuesday.

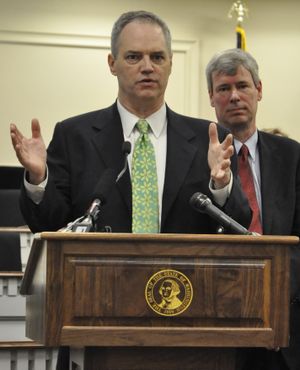

"I have the votes for this budget," Appropriations Chairman Ross Hunter, D-Medina said.

That means it would go to the Senate, where Republicans in the leadership of that chamber have repeatedly said they believe tax increases are not needed for a budget that adequately covers increases in education and mental health programs to comply with court orders as well as paying for other key state services and salaries. The Senate Majority Coalition Caucus is expected to release its budget proposal next week.

Senate Ways and Means Committee Chairman Andy Hill, Republicans' chief budget writer in that chamber, said he hadn't studied the House plan in detail but criticized it for raising taxes to improve education. The state will get a boost in revenue with the recovering economy, and Hill said money for schools should come out of that because education is listed as the state's paramount duty in the constitution.

"I don't know if that's unconstitutional, or just unconscionable," Hill said. "Do we need new taxes. That is the fundamental question."

House Democrats said to do the things the state needs, it does. Among key features of the House spending plan are:

* An extra $1.4 billion for public schools to meet the state Supreme Court order known as McCleary. That includes some $750 million in maintenance, supplies and operating costs, and amount with which Senate Republicans are likely to agree; the rest includes money for smaller class sizes in kindergarten through Grade 3, all-day kindergarten in districts throughout the state, and a cost-of-living increase for teachers and other school staff that is mandated by a voter initiative but regularly suspended by the Legislature in tough budget times. It does not include money to reduce class sizes above Grade 3, which is mandated under Initiative 1351, which voters passed last November.

* A freeze in tuition at state colleges and universities, and the $106 million extra in state money to those universities to cover that freeze. Senate Republicans have approved a cut in tuition that would tie it to the average state wage. The House plan has nearly $103 million in financial aid for college students.

* An extra $11 million for medical education, with $2.5 million going to Washington State University to seek accreditation for a new medical school in Spokane and $5.5 million to support students at the school when it starts. Another $3 million would be set aside for to find additional residency slots for family medicine in Washington through a network at the University of Washington. UW would also get $9.4 million transferred from WSU accounts to support more students in its WWAMI program in Spokane, so that by the end of the budget cycle UW would have 60 first-year students and 60 second-year students in Spokane.

* An extra $100 million for mental health care, including $35 million for more beds at community mental health facilities, an effort to address a court ruling that some mental health patients are being kept too long in hospital emergency rooms or in other inappropriate settings. It also would spend $23 million to add beds at state hospitals for court-ordered competency exams and restoration services.

The state's economic forecast assumes Washington will collect about $37 billion in taxes, fees and other revenue for its general fund in the two-year budget cycle starting July 1. Unlike the federal government, the state can't run a deficit. To cover the gap between that projection and the amount the budget would spend, House Democrats are proposing several separate tax bills.

"We have an unfair tax system that's a mess," Finance Committee Chairman Reuven Carlyle, D-Seattle, said.

Among the changes proposed:

* A 5 percent capital gains tax on investors that receive more than $25,000 individually, or $50,000 as a couple. Like the federal tax, it would exempt up to $500,000 for the sale of a primary home, retirement accounts, most agricultural lands and livestock, and most tax bills. "This is for the super-wealthy," Carlyle said.

To answer criticism that a capital gains tax is volatile, House Democrats are proposing to dedicate $400 million, an amount they believe is "virtually guaranteed" to be collected based on historic data, and place the remainder in a special fund that would be used to cover years when collections fall below that level. The capital gains tax would start in 2016.

* Raising the B&O tax rate on services from the current 1.5 percent of gross receipts to 1.8 percent. At the same time, the state would raise the exemption for small businesses from the current $56,000 to $100,000.

* Closing or changing seven tax preferences. The current exemption from sales tax that some residents of other states get would be changed to a refund those residents could claim on purchases of more than $25. The sales tax exemption for bottled water would be repealed, as would the use tax exemption for extracted fuel, and preferred B*O rates for royalty income, travel agents and prescription drug resellers. The real estate excise tax on some foreclosure sales would be limited.