Dow sheds 147, falls to yearly low

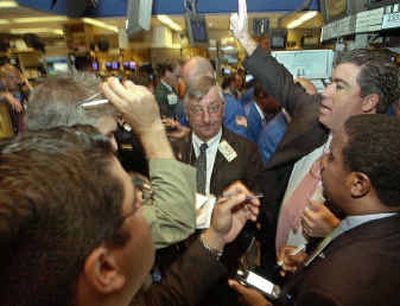

NEW YORK — The Dow Jones industrial average plunged nearly 150 points Friday to a new 2004 low as investors bailed out of stocks in the wake of a disappointing jobs report and continuing high oil prices. The Nasdaq composite index and Standard & Poor’s 500 also marked new year-to-date lows for the second straight session.

Payroll figures released early Friday showed employers added just 32,000 jobs last month, data low enough to warrant worries that a slowing in the economy in June may have been more just a brief pause.

Combined with oil prices still hovering near $44 a barrel, investors sold off heavily for a second straight day, worried that inflation and slow job growth would interrupt the economic recovery for a sustained length of time.

“We’ve broken through our lows for the year, and the outlook for the near future looks even more negative,” said Michael Sheldon, chief market strategist at Spencer Clarke LLC. “Today’s jobs data was clearly disappointing and calls into question the strength of the labor market, the strength of the economy and the strength of corporate profits over the next few quarters.”

The Dow fell 147.70, or 1.5 percent, to 9,815.33, the lowest close on the Dow since Nov. 28.

Broader stock indicators also fell sharply. The Standard & Poor’s 500 index dropped 16.73, or 1.6 percent, to 1,063.97, and the Nasdaq was down 44.74, or 2.5 percent, at 1,776.89. It was the lowest close for the S&P 500 since Dec. 10, and the lowest for the Nasdaq since Aug. 26, 2003.

For the week, the Dow dropped 3.2 percent, the S&P 500 fell 3.4 percent and the Nasdaq plummeted 5.6 percent. It was the worst weekly performance for the Dow since the second week of March, and the worst week of the year for the other two indexes.

The July job report reflects the weakest increase in hiring since December and comes after a revised gain of just 78,000 in June, even less than previously reported. Economists had forecast the creation of roughly 243,000 jobs for July.

Analysts said the employment data raised new doubts about what the Federal Reserve board of governors will do next week when it meets to discuss interest rates. The Fed had widely been expected to raise rates by a quarter percentage point to 1.5 percent.

The job figures “were a big surprise and they clearly rocked the market,” said Hugh Johnson, chief investment officer at First Albany Corp. “Now the debate will be intense about what they (the Fed) will do next week at their meeting, very intense. It creates just enough uncertainty.”

Interest rate questions were reflected by a surge in demand for bonds, briefly pushing the interest rate on the benchmark 10-year note as low as 4.17 percent, a level not seen since the spring. Bond yields move in the opposite direction of their price.

While many analysts were looking to the Fed’s statement following Tuesday’s meeting for a possible boost to stocks, even a positive outlook might not be enough to assuage investors.

“We have to get to a level where people find valuations attractive again. That’s just not the case at these levels,” said Richard Dickson, senior market strategist at Lowry’s Research Reports in Palm Beach, Fla. “Where these lower prices are, I wish I knew. I’d put in a buy order right now and get rich. But there’s no telling where the selling might stop.”

On the stock market, decliners included Halliburton Co., which faces accusations of accounting fraud in a new lawsuit brought by investors. The company’s shares were down 44 cents at $29.67.

Shares of General Motors tumbled $1.05 to $41.49 following the company’s announcement Thursday that it was recalling all Saturn Vue sport utility vehicles manufactured since 2001.

Stock in newspaper publisher Belo Corp. also fell $1.66 to $21.55 after the company reported that its Dallas Morning News had overstated its circulation.

Reflecting the uncertainty in the job market, Labor Ready Inc., which recruits and provides day laborers, saw its shares fall 68 cents to $12.20.

Declining issues outnumbered advancers by more than 2 to 1 on the New York Stock Exchange, where preliminary consolidated volume came to 1.81 billion shares, up from 1.7 billion shares traded on Thursday.

The Russell 2000 index of smaller companies was down 12.71, or 2.4 percent, at 519.65, also a new low for the year.

Overseas, Japan’s Nikkei stock average fell 0.8 percent. In Europe, Britain’s FTSE 100 closed down 1.7 percent, France’s CAC-40 finished down 2.6 percent and Germany’s DAX index was down 2.7 percent.

The Dow Jones industrials ended the week down 324.38, or 3.2 percent, finishing at 9,815.33. The S&P 500 index lost 37.75, or 3.4 percent, to close at 1,063.97.

The Nasdaq fell 110.47 or 5.9 percent, during the week, closing Friday at 1,776.89.