Tax overhaul may be less than sweeping

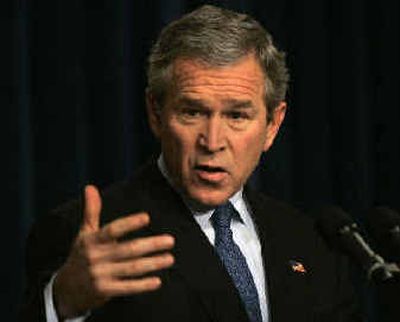

WASHINGTON — President Bush’s campaign to make the tax code simpler, fairer and more pro-growth is likely to involve incremental changes to the current system rather than a sweeping effort to scrap the venerable income tax for a radically new approach, such as a national sales tax.

But the changes Bush will propose are still expected to generate huge opposition, especially if he suggests scrapping favored tax breaks such as the deduction for state income tax payments.

Tax experts in close contact with the administration say signs are pointing toward a plan that will seek to improve the income tax code, rather than replace it with a single-rate flat tax with no deductions, a national sales tax or Value Added Tax, all ideas that gained prominence among conservative Republicans in the 1990s.

“Our members think the current tax code is way too complicated, but given the realities of the budget deficit and the embedded interests in the current tax code, it is very hard to make major changes,” said Dan Danner, senior vice president for public policy at the 600,000-member National Federation of Independent Business. His group campaigned in the early 1990s to “Sunset the Code” and replace it with a simpler tax system.

For its part, the administration insists that no decisions have been made on details of a tax overhaul.

“The president has said he wants to look at all the options that would make the code fairer, less complex and more growth oriented,” Treasury Secretary John Snow said in an interview.

But tax analysts noted the administration did not showcase any radical tax reforms at last week’s two-day White House economic conference, preferring instead to review incremental changes.

Analysts seeking insight into Bush’s thinking have seized on a November 2002 internal Treasury Department memo by Pamela Olson, then assistant treasury secretary for tax policy. Her fifth option, described as the “least radical,” could serve as a blueprint for Bush’s tax reform push, analysts say.

While retaining the current income tax system, this option would eliminate the Alternative Minimum Tax, which was designed to make sure the rich paid their fair share of taxes but is now ensnaring more middle-income taxpayers.

Eliminating the AMT, which covered 3 million mostly wealthy taxpayers in 2004 but will raise the taxes of 23 million taxpayers by 2008, would cost the government an estimated $600 billion over 10 years.

To pay for that and the more generous savings accounts, the “least radical” proposal would eliminate the itemized deduction for state and local income taxes, while imposing a tax on Social Security benefits and employer-provided health care benefits.

Members of Congress are vowing to fight any effort to eliminate state and local income tax deductions.