Credit companies resist anti-identity theft freeze

NEW YORK — Little by little, a weapon against identity theft is gaining currency — but few people know about it.

It’s called the security freeze, and it lets individuals block access to their credit reports until they personally unlock the files by contacting the credit bureaus and providing a PIN code.

The process is a bit of a hassle, and the credit-reporting industry believes it complicates things unnecessarily.

But it appears to be one of the few ways to virtually guarantee that a fraudster cannot open an account in your name.

The freeze became an option in California and Texas last year, and Louisiana and Vermont will allow it beginning next July. However, the Texas and Vermont laws apply only to people who already have been victimized by identity theft.

Only 2,000 Californians and 150 Texans have taken advantage of the freeze, according to Experian Inc., one of the three major credit bureaus.

But identity theft watchdogs say usage is low simply because the credit bureaus don’t publicize the option. With identity theft apparently growing, the advocates hope the freeze gains national momentum. Congress resisted calls for a freeze rule during debate over a major credit law last year.

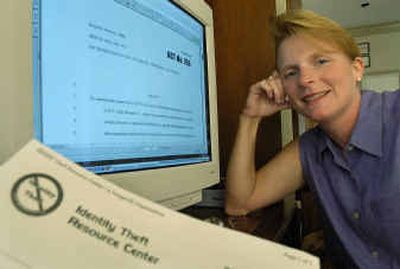

“It’s the best protection we have,” said Linda Foley, executive director of the Identity Theft Resource Center in San Diego.

While the freeze may be an extreme step, its backers say it is necessary because the existing system is broken.

The Internet and consumer databases have made it easier than ever to find someone else’s social security number and apply for accounts in that name. Meanwhile, obtaining credit is a breeze, as zero-percent financing offers crowd our mailboxes and appliance stores make no-money-down come-ons.

People who suspect trouble can place fraud alerts on their credit reports. But identity theft watchdogs say the alerts are often ignored by creditors who are willing, say, to gamble that the potential plasma TV purchaser in front of them is legitimate, and write off any losses that might occur if the person turns out to be a con artist.

That scenario is “unfortunately not uncommon,” said Joanne McNabb, chief of the California Office of Privacy Protection.

A 2003 study for the Federal Trade Commission determined that in the previous year, 3.2 million Americans’ personal information had been stolen by thieves who opened new accounts or loans. On average, victims lost $1,180 and spent 60 hours resolving the problem.

The freeze costs nothing for ID theft victims in the states it is allowed.

For everyone else in California and Louisiana, the initial freeze is $10. Unfreezing it temporarily is $8 in Louisiana and up to $12 in California. But the cost of each step is multiplied by three because it must be performed with all three major credit bureaus, Experian, Equifax and TransUnion.

With the freeze on, if someone applies for credit in your name, the creditor will be unable to check your history, and the applicant will get rejected. (The freeze won’t keep credit card offers out of the mail — those are generated through a “prescreening” process that doesn’t require full examination of your credit until you actually apply for the card.)

If you want to apply for credit or let someone run a background check on you, you have to call the credit bureaus, provide the PIN, and say who — a landlord, for example — will be inquiring about your history. Or you can thaw the credit report for a given period of time — a week in which you’re shopping for cars, for example.

“It’s like putting a new lock and key on your security files,” said Bridget Thomas of Prairieville, La., who lobbied for the freeze in her state after a woman with the same name — but a different middle initial — got Thomas’ social security number and went on a spending spree that wrecked Thomas’ credit status.