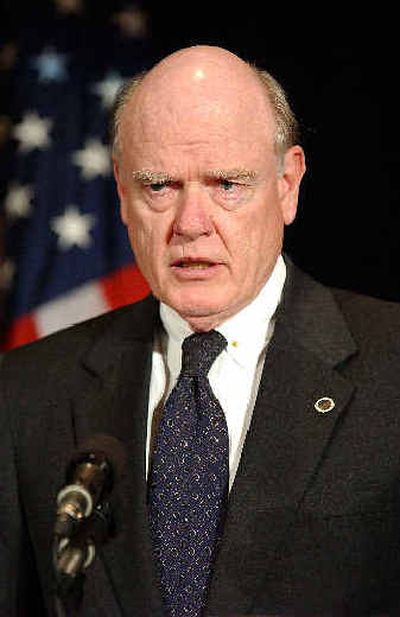

Snow discovers $10M mistake in his portfolio

WASHINGTON – Treasury Secretary John Snow, a strong advocate for tighter government controls over the biggest players in the nation’s mortgage industry, has discovered that he inadvertently owned more than $10 million in debt issued by those government-sponsored enterprises, the Treasury Department said Wednesday.

Snow, who found the entire incident “very regrettable,” has sold the holdings at a loss of $478,000 even though a Treasury Department ethics officer has ruled there was no conflict of interest, Snow spokesman Robert Nichols said.

Nichols said that the mistake occurred because of a misunderstanding between Snow and his investment adviser.

Snow, who took the Treasury post last year after heading up railroad giant CSX Corp., told his adviser to invest in Treasury bonds to avoid any conflict of interest.

However, the adviser believed he had the power to invest in the bonds of such companies as Fannie Mae, Freddie Mac and the Federal Home Loan Banks as well as U.S. Treasury bonds. The investor purchased $10.87 million of the corporation’s bonds for Snow’s portfolio without Snow’s knowledge.

While Snow has been receiving periodic financial statements over the past year showing that he owned the mortgage company bonds, Nichols said Snow did not bother to open the statements.

The fact that he owned the bonds was only discovered during a routine Treasury Department review of his financial disclosure statement.

Snow immediately ordered that the holdings be sold. A Treasury ethics officer ruled that Snow’s holdings did not constitute a conflict of interest. But Snow has requested that the department’s inspector general also look into the case.

“He finds this very regrettable,” Nichols told reporters during a briefing late Wednesday. “He is committed to the highest standards of ethical conduct and he is upset.”

Snow, who led CSX Corp. for 14 years, received $60.8 million in cash, stock and pension money when he resigned to join the Bush Cabinet in February 2003, according to a filing last year CSX made with the Securities and Exchange Commission.

Snow used an investment adviser to restructure his portfolio so that there would be no conflict of interest with his holdings and his new job as treasury secretary, Nichols said.

Snow said he was asking Treasury’s independent inspector general to review the finding of Treasury ethics officers that he had not violated any conflict of interest laws because of his “commitment to the highest standards of ethical conduct for myself and the department.”

Snow’s 34-page financial disclosure statement gave his holdings only in broad categories.

When he was picked to succeed Paul O’Neill, who was fired in December 2002 in a shake-up of the administration’s economic team, Snow’s net worth was estimated to be between $77 million and $297 million.

Snow promised during his Senate confirmation hearings to sell his extensive stock holdings in CSX and 60 other companies and to forgo a severance payment from the company of $15 million.

However, he did receive, according to the company’s SEC filing, $60.8 million in cash, stock and pension money when he resigned on Feb. 3, 2003.

Many corporate executives receive deferred compensation when they leave under agreements that allow the money to grow tax-free during the years that they are employed at the company.