Oil prices fall as supply fears ebb

Crude oil futures prices fell below $47 a barrel Monday as fears of a winter supply crunch continued to ease and Nigeria’s main labor union called off a strike that had threatened to disrupt exports.

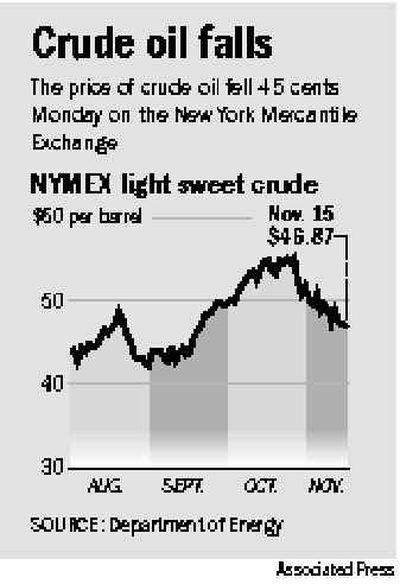

With U.S. oil inventories on the rise in recent weeks, the front-month futures price is now more than $8 per barrel lower than the record close of $55.17, reached twice late last month.

“There’s more than ample crude right now,” said Ed Silliere, vice president of risk management at Energy Merchant in New York.

Moreover, speculative traders are beginning to acknowledge this and placing more bets that oil prices will fall, Silliere said, and that itself adds to the downward momentum.

Light, sweet crude for December delivery settled at $46.87 per barrel, down 45 cents on the New York Mercantile Exchange. Heating oil futures tumbled 2.05 cents to $1.3431 per gallon as traders see the rising crude inventories to be a signal that more refined products are on the way.

In London, Brent crude for December delivery settled at $40.34 on the International Petroleum Exchange, down $1.97.

Nigeria’s main labor union on Monday indefinitely suspended a looming nationwide strike that had threatened to shut down the oil industry in the world’s No. 7 exporter.

Suspension came after the government agreed to lower domestic fuel prices — a key demand of unions.

The news contributed to the market’s improving supply outlook.

Output has been reviving in the Gulf of Mexico, where daily production is still about 13 percent below normal levels but significantly higher than a month ago, when oil companies struggled with the damaging after-effects from Hurricane Ivan.

Commercially available crude supplies have been growing for nearly two months, according to the U.S. Energy Department, and traders expect the agency’s Wednesday report to show another rise.

“Right now, short term, the market looks bearish,” said Jamal Qureshi, an oil market analyst at PFC Energy in Washington. “But if you get even a normal winter, get ready for a sharp swing back.”