Insurance scams alleged

ALBANY, N.Y. — New York’s attorney general sued the nation’s leading insurance brokerage Thursday, accusing brokers of taking payoffs to steer clients to insurance companies that were not necessarily offering the lowest prices for their policies.

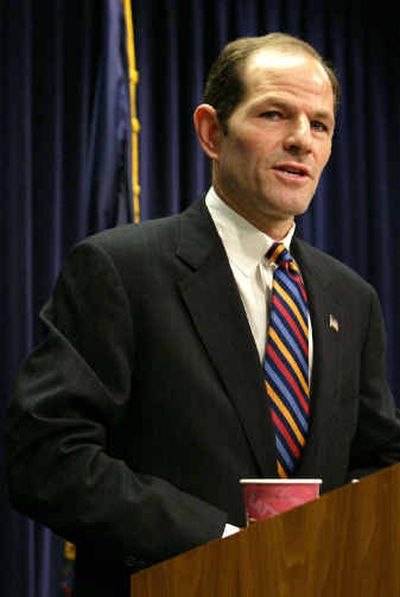

Besides naming brokerage Marsh & McLennan Cos., the suit implicated four insurers, including American International Group. Two AIG executives pleaded guilty Thursday and are expected to testify in future cases, Attorney General Eliot Spitzer said.

New York law requires insurance brokers to offer their clients the best prices they can find, Spitzer said.

The victims were mostly large corporations that were deceived into spending more than they had to for property and casualty coverage, but also included small and mid-size businesses, municipal governments, school districts and individuals, Spitzer said.

“The damages are vast, the corruption is remarkable,” he said. “I don’t know how far up we will establish criminal liability, but those who are implicated will face criminal charges.”

Spitzer said Marsh had long-standing agreements to steer clients to insurers for lucrative payoffs. The company collected $800 million in so-called contingent commissions in 2003 alone, investigators said.

AIG and three other insurers — Philadelphia-based ACE Insurance Co. of North America, Hartford, Conn.-based The Hartford and Germany’s Munich American Risk Partners — were accused of contract steering and bid rigging.

Other insurance companies are being investigated, said Spitzer, who has already forced Wall Street to adopt measures against conflicts of interest among stock analysts and improper trading at mutual fund companies.

Leaders of three of the companies have close family ties. Maurice Greenberg heads AIG, his son Jeffrey is chief executive of Marsh & McLennan, and another son, Evan, is president and CEO of ACE and was AIG’s CEO from 1997 to 2000, according to Hoovers.com.

On the stock market, Marsh lost more than 24 percent of its value Thursday.

Marsh said it was cooperating with Spitzer and was unaware of the charges until they were announced.

The Harford said it was cooperating in the investigation and does not condone bid rigging or other illegal activity. The three other named insurance companies had no immediate comment.