Former investment banker sentenced

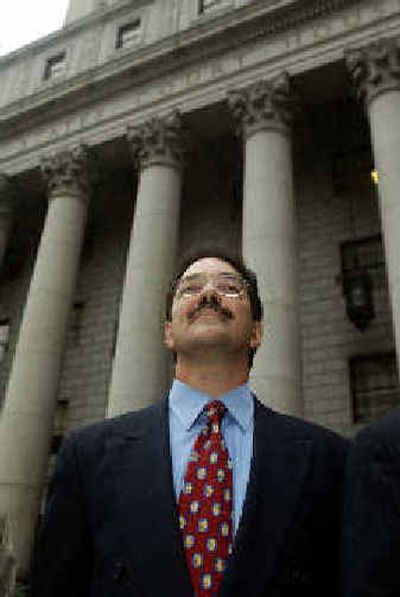

NEW YORK — Former star investment banker Frank Quattrone, who made tens of millions of dollars as he rode the Internet stock boom, was sentenced to 1 1/2 years in prison Wednesday for obstructing government probes of hot new tech stock offerings.

U.S. District Judge Richard Owen ordered Quattrone to surrender in 50 days, and granted a defense request to recommend that Quattrone be sent to a prison camp in California, where he lives. He also was fined $90,000 and sentenced to two years’ probation.

The judge enhanced the sentencing guideline range after agreeing with prosecutors that the former Credit Suisse First Boston banker had lied on the witness stand when he testified he did not intend to obstruct justice. Probation officials had recommended five months in prison and five months of home confinement.

Before the sentencing, Quattrone told Owen in Manhattan in a steady voice: “I humbly ask that you show mercy and compassion for me and my family, for whom any separation from me would be extremely detrimental.”

Quattrone’s wife is chronically ill, and Quattrone’s lawyers have said his 15-year-old daughter has had psychological problems.

Owen said the impact on the family could be softened by its financial assets; the wife has $50 million and the daughter has $26 million in a trust fund.

The judge noted that it was not unusual that family members would suffer after a father and husband was convicted of a federal crime. “That’s one helluva blow to a child,” he said.

The sentence makes Quattrone, 48, the most prominent Wall Street figure since junk-bond dealer Michael Milken to face time behind bars.

The Quattrone case turned on a 22-word e-mail that Quattrone forwarded to CSFB bankers on Dec. 5, 2000, encouraging them to “clean up” their files before the holidays.

Quattrone added: “I strongly advise you to follow these procedures.”

At trial, Quattrone claimed he was not thinking about ongoing government investigations when he sent the e-mail. He contended it was a simple reminder to follow the company’s document-retention policy.

Quattrone was tried on the same three charges — obstructing a grand jury, obstructing federal regulators and witness tampering — last fall, but that trial ended in a hung jury.

Quattrone’s investment-banking stamp was on some of Silicon Valley’s flagship companies in the late 1990s — Amazon.com, Netscape Communications Corp., Cisco Systems and Intuit, among others.