Wholesale prices, trade deficit ease

WASHINGTON – The economy got a double dose of encouraging news Friday as wholesale prices went down and moderating energy costs helped improve the country’s trade deficit.

The latest batch of economic reports suggested inflation, for the most part, is under control, and the economy has emerged from a late spring lull and, in the words of Federal Reserve Chairman Alan Greenspan, “regained some traction.”

“We appear to be coming out of the soft patch,” said Oscar Gonzalez, economist at MFC Global Investment Management.

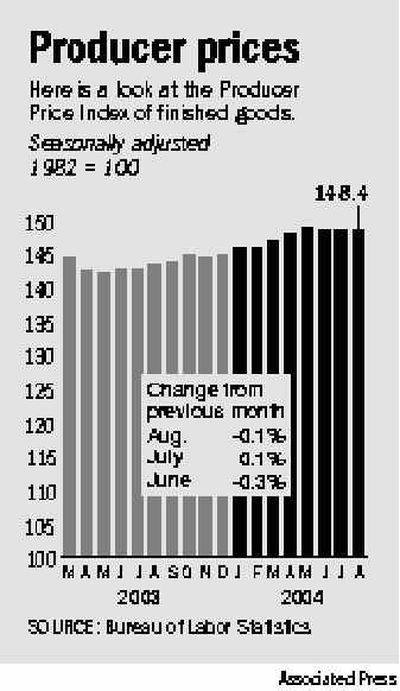

The Labor Department’s Producer Price Index, which measures costs of goods before they reach store shelves, dipped 0.1 percent in August after edging up by 0.1 percent in July. Cheaper gasoline, cars and food helped restrain wholesale prices last month.

Excluding food and energy costs, core prices watched closely by economists also fell 0.1 percent in August, their first decline since February and an indication that most other prices were well-behaved, analysts said.

For the first eight months of the year, overall wholesale prices have increased at an annual rate of 3.8 percent, compared with a 4.6 percent advance for the same period last year.

The Commerce Department, meanwhile, reported that the U.S. trade deficit shrank to $50.15 billion in July as U.S. exports rose and imports declined for the first time in nearly a year. The decline reflected a drop in the foreign oil bill.

July’s trade deficit was 8.9 percent smaller than the record $55.02 billion trade gap registered in June.

U.S. exports rose a solid 3 percent in July from the previous month to $95.86 billion, the second-highest level on record. Imports fell 1.4 percent to $146 billion.

Although July’s trade deficit remained the second-highest imbalance ever recorded, the improvement from the previous month raised hopes among economists that the trade gap will become less of a drag on the economy in the July-to-September quarter.