Napster sings a new tune, goes public

SAN JOSE, Calif. — Call it the kitty’s third life.

Roxio Inc. bought the Napster brand name and feline logo at a bankruptcy auction two years ago and with the acquisition of another music service, pressplay, relaunched the once-renegade file-swapping pioneer as a legal music service last October.

Now in its latest reincarnation, Roxio has shed its CD-burning software business and plans to concentrate solely on selling and delivering music over the Web. It will adopt Napster as its corporate name, trading under a new ticker symbol.

The pure-play move will mark Napster’s birth as the name of a public company, but more importantly, arm the company with resources to help survive the rough-and-tumble as other deep-pocketed, powerful rivals enter the crowded online music space.

In the past two weeks, Microsoft Corp. debuted its online music service, and Yahoo Inc. acquired online jukebox provider Musicmatch Inc. EMI Group’s Virgin is among those expected to soon join the fray, which already includes the pioneer of legitimate downloads and the current market leader, Apple Computer Inc.

Roxio’s sale of its software business to Sonic Solutions for $80 million in cash and stocks will give Napster a cash base of more than $100 million once the deal closes, expected by year’s end.

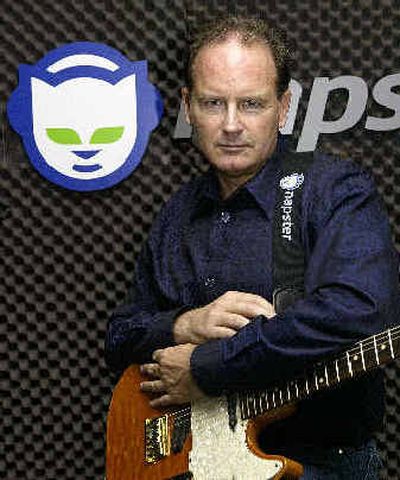

“One of the most important questions for our investors is, ‘Does Napster have the staying power to stay and thrive?’ Having the cash answers that question,” said Chris Gorog, chief executive and chairman of Roxio.

It will be more than enough to cover Napster until it becomes profitable, Gorog said, “and we’re on a clear path to do that.”

Roxio’s revenues grew 24 percent to $29.9 million in the April-June quarter compared with a year ago, though the company had a net loss of $2.6 million, or 8 cents per share, dragged in part by the Napster unit’s $8.1 million loss.

But Gorog said Napster’s sales are growing at a double-digit rate — it increased by more than tenfold to $7.9 million that quarter — and he projected online music revenues will reach $30 million to $40 million this fiscal year.

Analysts say Napster has its work cut out.

Napster’s key strategy is to ramp up its subscription service, which costs users $9.95 a month for unlimited access on their computers to more than 750,000 songs. With the debut of a “Napster To Go” premium service this fall — initially set to cost an additional $5 a month — subscribers soon will also be able to transfer the tunes to compatible portable music players.

Napster must “deliver compelling marketing messages to educate consumers about the value of a subscription rather than a download model,” said Mike McGuire, analyst with Gartner G2 market research firm. “The consumer has to see that it’s a better way, not just a different way, to get their music.”

The relatively easy concept behind the pay-per-download model will make it the more dominant of the two for at least the next couple of years, McGuire said.