Retail sales increase modestly

Consumers hit by higher gasoline costs cut back spending on clothes and many other items last month, raising concerns about whether the economy might be entering another “soft patch” similar to last year’s slowdown.

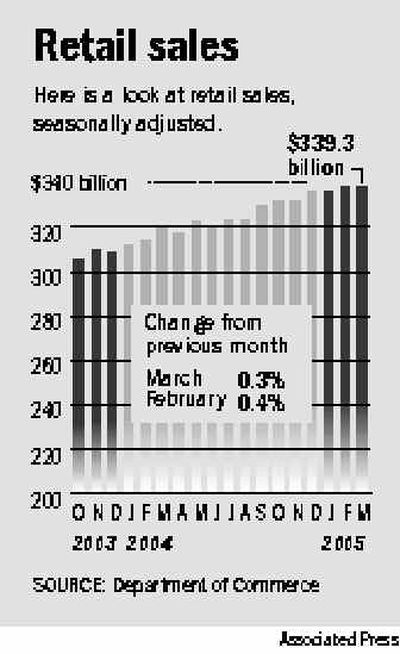

The Commerce Department reported Wednesday that retail sales rose a disappointing 0.3 percent in March, far below expectations for a 0.8 percent rise.

What strength there was came mainly from auto sales, which climbed 0.7 percent in March. Excluding autos, retail sales rose by just 0.1 percent last month, the weakest showing in nearly a year, since a 0.1 percent drop in April 2004.

That decline occurred as the U.S. economy was entering what Federal Reserve Chairman Alan Greenspan termed a “soft patch” as growth slowed abruptly during the spring of last year. Consumers at that time, too, were hit by higher energy bills, and they responded by abruptly cutting back their spending in other areas.

Analysts said the same thing could be occurring again this year although more data will be needed to confirm that.

“The higher price of gasoline may just be braking the consumers’ drive to spend,” said Joel Naroff, chief economist at Naroff Economic Advisors in Holland, Pa. “There were major cutbacks in spending on clothing, furniture and appliances.”

Bill Cheney, chief economist at John Hancock Services in Boston, said the economy could be entering another slowdown induced by higher energy prices, but he cautioned against reading too much into a single month’s report.

“Obviously the weakness in March is a concern, but it is putting too much weight on one month’s report to suggest this is a new trend,” Cheney said.

Wall Street took notice of the disappointing retail sales report, with the Dow Jones industrial average off 13 points in early trading.

The 0.3 percent rise in retail sales followed a stronger 0.5 percent gain in February and was the smallest advance since a tiny 0.1 percent rise in January, which had followed a 1.3 percent surge in December.

The strength in auto sales was offset by a 0.7 percent decline at general merchandise stores, a category that includes department stores and an even larger 1.9 percent drop at clothing specialty stores.