Bankruptcy protection will be harder to get

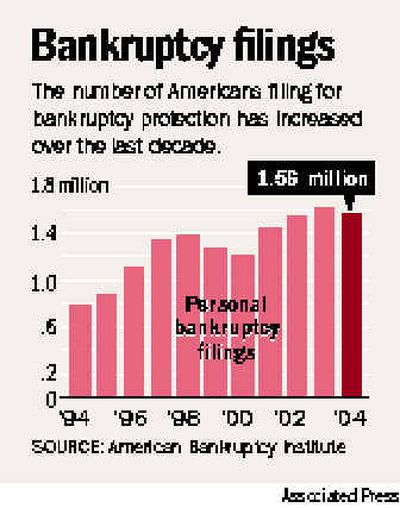

WASHINGTON – The House gave final passage Thursday to legislation intended to make it harder for tens of thousands of consumers to wipe out debt through bankruptcy, clearing the way for President Bush to sign the bill into law as he has promised to do.

Lawmakers voted 302 to 126 for the bill, which is identical to a measure the Senate passed last month. It would make the most significant changes to bankruptcy law since 1978. Its passage by Congress marks a coup for executives in the credit card, retail and auto financing industries, which have pushed it for nearly a decade. They argue the changes are necessary to weed out abusers of the system who use Chapter 7 bankruptcy to shirk debts they can afford to pay.

Sen. Charles Grassley, R-Iowa, the chief sponsor of the bill, said the bill would preserve two key principles: Those able to pay some of their debts would have to do so, and those who need a fresh start would still be able to extinguish their debt through bankruptcy.

Consumer advocacy groups and many Democrats, who fought the legislation, disagree, arguing that lenders’ liberal credit policies and aggressive sales practices have been equally responsible for putting many Americans over their heads in debt. They say the new legislation would be too harsh on individuals driven into debt by job loss, sickness, divorce or military duty. That is especially unfair, they say, because the bill would preserve loopholes that enable wealthy individuals who file for bankruptcy to shield unlimited amounts of money in complex trusts and in multimillion-dollar homes in states including Texas and Florida.

“The big winner under the new law will be credit card issuers, whose reckless and abusive lending practices have driven many Americans to the brink of bankruptcy,” said Travis Plunkett, lobbyist for the nonprofit Consumer Federation of America. “Now that Americans in bankruptcy will have to pay more back to creditors, they have a right to expect that credit card companies will lower their interest rates and fees. We will be watching credit card companies closely to see if they will become more responsible corporate citizens in return for this unprecedented gift from Congress.”

Proponents estimate that approximately 100,000 debtors of the 1 million a year who now file Chapter 7 bankruptcy could repay more than the current system requires. Opponents say the number is closer to 30,000 but that, in any case, the new legislation does little to weed out abuse. Instead, they say, it adds red tape to the process and makes it more expensive by requiring debtors to seek counseling before filing for bankruptcy.

The legislation will become law six months after Bush signs it, which he must do within 10 days or it becomes law automatically.

The central feature of the new bill is that it would take away much of the discretion bankruptcy judges have in deciding who is eligible to wipe out substantial portions of debt by filing under Chapter 7 and who should be forced into filing for Chapter 13 bankruptcy, which requires some repayment of obligations over several years. Instead it would require judges to calculate eligibility by applying a formula, based on income and expenses, to would-be filers whose annual income is above the median in the region in which they live. Those who are required to file under Chapter 13 would have to make repayment for five years. Under current law, those payments cease after three years, even if the debt is not fully repaid.

It also would make consumers who file for bankruptcy wait two to four years longer before they can file again.

The credit card industry defeated a provision that would have required credit card issuers to tell consumers how much more interest they would be charged if they opted to pay only the required minimum each month. But the bill would require companies, upon request, to tell customers how long it will take to pay off a debt by remitting minimum amounts. And the bill retains a provision business groups had tried to kill that would give bankruptcy courts more authority to limit the amount of money executives and other corporate insiders can take in bonuses and severance pay from companies filing for bankruptcy protection.

Lobbyists and others who tracked the bill’s passage say the biggest winner under the new law would not be the credit card industry but rather automobile manufacturers, which often provide financing for the cars they sell. The new legislation would put car companies ahead of most other creditors in line for payment.

But others focused on the broader changes that the bill would create.

“The essential philosophical and political divide over the bankruptcy bill boils down to whether you see filing for bankruptcy as a right or a privilege,” said John McMickle, a lawyer who was formerly the bankruptcy lawyer for the Senate Judiciary Committee. “The new law makes bankruptcy a privilege reserved only for people who can prove they can’t repay their debts.”