Taxpayers face more audits

WASHINGTON – It’s enough to cause a momentary panic, to make your heart race and blood pressure rise. A letter from the Internal Revenue Service just can’t be good.

The government has been examining more tax returns, doing more audits and independently verifying more information. Large corporations and wealthy individuals, in particular, have been in its sights.

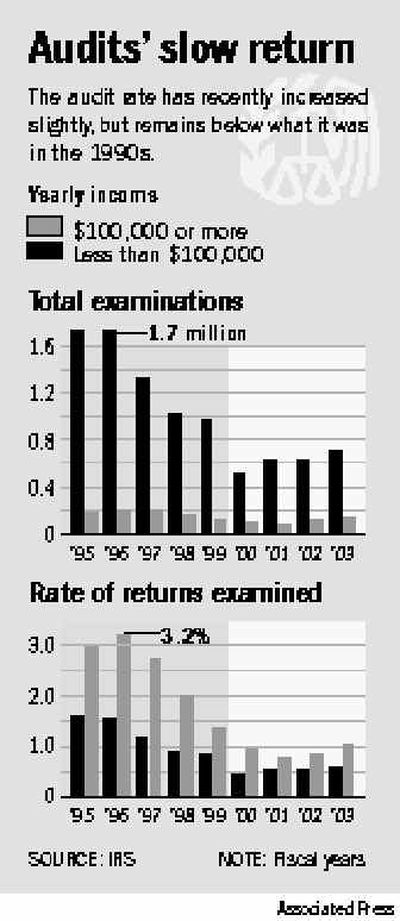

Yet the chance of an audit remains small. Last year, the IRS looked at about 1 in 129 returns filed by individuals and families. The rate increased to 1 in 68 when incomes rose above $100,000.

That still lags the pace set in the mid-1990s, when the agency looked at about 1 in 60 individual tax returns.

But the IRS doesn’t always need to conduct a full audit to catch mistakes and missing information. It increasingly relies on computers to verify what’s reported, making it harder for taxpayers to hide some types of information.

That doesn’t always mean the IRS is right and the taxpayer is wrong. One thing is certain, experts say, and that’s the importance of answering any letter sent from the IRS.

“Taxpayers have to respond to the IRS. They can’t be ostriches,” said National Taxpayer Advocate Nina Olson, who helps taxpayers resolve problems with the IRS. “You have to pick up the phone, even if you just want to just go hide. It won’t go away.”

IRS document matching programs mean taxpayers should act quickly to correct any errors in the statements they get from their financial institutions, said Bob Sharin, editor of RIA’s Practical Tax Strategies.

Even if you report the correct information on your tax return, the IRS will only know that the information you provide differs from the information the third party provided.

“That’s going to be a red flag,” Sharin said.

Some of the most common problems that generate letters can be avoided by filing electronically and letting the computer check for valid Social Security numbers and math errors. If you fill out the forms by hand, make sure to double- and triple-check your work.

The IRS has no single formula that determines which tax returns will be audited. The agency audits some taxpayers by mail and others in face-to-face meetings, depending on the complexity of the return.

It screens returns for potential irregularities and uses information gleaned from other taxpayer audits to find areas with frequent problems, caused either because the rules are too complex or because practitioners and taxpayers “play in the gray areas,” Stiff said.