WorldCom trial near conclusion

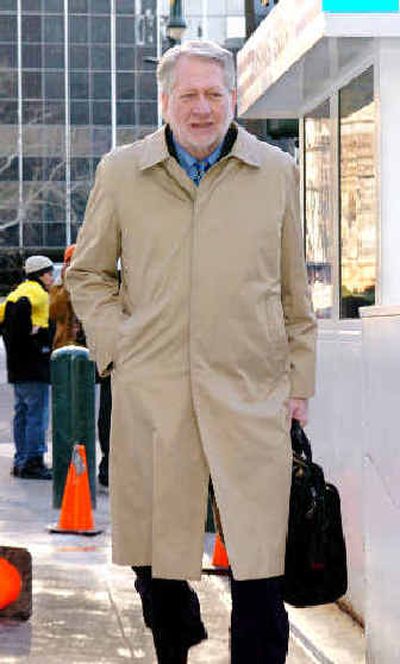

NEW YORK — A lawyer for ex-WorldCom Inc. chief Bernard Ebbers turned his closing argument Thursday into a blistering attack on star prosecution witness Scott Sullivan, calling him a crafty liar with Broadway-worthy acting skills.

In a final plea to jurors to acquit Ebbers of fraud, lawyer Reid Weingarten laid the blame for WorldCom’s massive accounting fraud squarely on Sullivan, who served as chief financial officer under Ebbers.

He portrayed Sullivan, who has pleaded guilty in the case, as a mastermind of fraud who blamed Ebbers only in hopes the government will help him win a lighter prison sentence.

“He was more rehearsed on his direct testimony than the actor who plays Hamlet on Broadway,” Weingarten said. “It’s hard to come up with a script where a witness has a greater motive to lie.”

Jurors are likely to get the case this morning.

On Wednesday, a federal prosecutor suggested that money, power and pressure — particularly $400 million in personal loans backed by WorldCom’s tumbling stock — led Ebbers, 63, to commit the fraud.

But Weingarten told jurors that when he heard the government closing argument, “I thought I was in the wrong courtroom.”

He noted that, as Bank of America issued one margin call after another on the loans because of the falling stock price, WorldCom stepped in to guarantee the loans — taking the pressure off the CEO.

If Ebbers had wanted to cook the books, Weingarten said, “the first thing you would do is dump your stock.” Ebbers did not sell — and even bought WorldCom stock after he resigned as CEO in April 2002. WorldCom later sought bankruptcy protection and emerged as MCI Inc.

Weingarten also went after another key government witness, former WorldCom controller David Myers, who claimed Ebbers apologized to him in October 2000, at the start of the fraud, for what accountants had been forced to do.

The defense lawyer said Myers was similarly trying to avoid prison time. He also called Myers a “puppy dog” for Sullivan, and said the pair had a history of “playing with the numbers” dating to 1997.

“When it comes to Sullivan and Myers doing their thing, you won’t see any CC’s to Bernie Ebbers,” Weingarten said, referring to e-mails between the two. Of the supposed apology, he said, “Myers just made it up.”

But Weingarten reserved his strongest rhetoric for Sullivan, the only government witness to directly link Ebbers to the fraud.

He described Sullivan as a brilliant, highly respected accountant who became drunk on his own power — and compared his zeal for falsifying the numbers to his admitted past use of cocaine.

Weingarten ticked off a series of what he called lies in Sullivan’s testimony and contradictions with the testimony of other witnesses and documents that were produced as evidence.

In a rebuttal statement — the government’s final argument to jurors — prosecutor David Anders sought to bolster Sullivan’s credibility, admitting Sullivan had lied in the past but saying he had come clean.

“Scott Sullivan was a candid and forthright witness. He was never evasive in answering any questions,” Anders said. “He has one motive here, and that’s to tell the truth.”