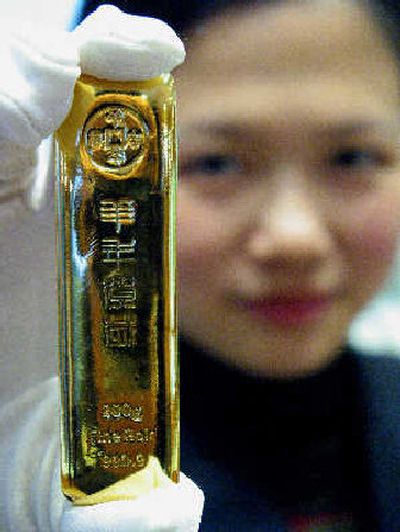

Gold prices break $500-an-ounce mark

TOKYO — Gold prices broke through the critical threshold of $500 an ounce in Asian trading Tuesday for the first time since late 1987, driven by investor demand for the metal as a diversifying asset. Prices retreated in later trading.

A fourth consecutive day of strong Japanese buying sent gold above the milestone, traders said, bringing the metal’s gains to 10 percent in less than four weeks.

“Quite a few people were calling for $500 gold before the yearend, and here we are,” said Doug Belanger, president of Gold Reserve Corp., a Spokane-based mining company. “There’s certainly nothing magical about $500 gold, though it does capture the attention of the news media. … I call it the theory of round numbers.”

Gold Reserves’ stock price inched up 4 cents Tuesday, closing at $2.06 per share. Higher gold prices are a positive signal for the company’s plans to build a large gold mine in Venezuela. Belanger hopes to start construction next year on the Brisas Mine, which would produce an estimated 480,000 ounces of gold annually. Financing for the mine is based on gold prices of $400 per ounces, he said. “At $500 gold, it looks that much better.”

Spot gold rose as high as $502.80 per troy ounce in intraday trading before slipping back to settle at $499.20 in New York trading.

December gold futures settled on the New York Mercantile Exchange at $499.10 an ounce, up 80 cents from the previous day.

December silver was 5.7 cents lower at $8.296 an ounce.

Gold’s appeal as a hedge against currency weakness, inflation and financial instabilities in general has driven the recent rise in prices, traders said.

Japanese buyers are apparently being encouraged by strong technical trends and possibly concerns about further yen weakness, Barclays Capital said in a report.

Recent reports that Russia wants to buy more gold in a bid to diversify its foreign reserves have also helped push gold higher, Tokyo traders said.

Opinion is divided on gold’s next immediate move, but there is general agreement that the market could see further gains in the longer run. Some participants expect to see profit-taking in a technically overbought market, while others say sentiment seems strong enough to lift prices higher.

“It’s difficult to say now. The market expected some selling around this level but the Japanese just keep on buying,” said Ellison Chu, senior manager at Standard Bank London’s Hong Kong office.

Chu and other traders in Asia expect spot prices to “shuffle along” between current levels of $495 to $502 in upcoming sessions in preparation for a run toward the next major upside target at $520 to $530 an ounce.

In Tokyo trading, investors sold gold futures to take profits, but traders said gold prices may rise further if they end in New York above $500.