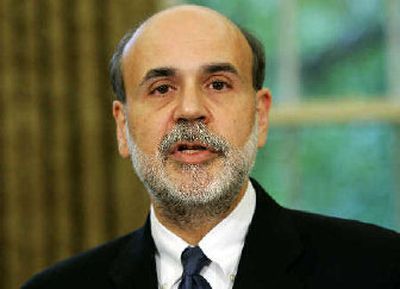

Bush finds ‘right man’ to replace Greenspan

WASHINGTON — Ben Bernanke, an economist known for intellectual curiosity, posed a question in The Wall Street Journal five years ago: “What Happens When Greenspan is Gone?”

President Bush gave his answer Monday: He will replace retiring Federal Reserve Chairman Alan Greenspan with Bernanke.

Bernanke, 51, is an Ivy League-trained academic, a former member of the Federal Reserve’s Board of Governors and the chairman of the president’s Council of Economic Advisers since June.

“Ben Bernanke is the right man to build on the record Alan Greenspan has established,” Bush said from the Oval Office, summing up a resume of scholarly achievements, written accomplishments and academic pursuits.

The bearded Bernanke stood nearby, as did Greenspan who had consulted with Bush on his replacement. Bush had called Bernanke from Air Force One on Friday, and he offered him the job early Monday morning in a White House meeting.

The president mentioned Bernanke’s speeches — “widely admired for their keen insight and clear, simple language.”

In other words, he doesn’t talk like Greenspan.

While “irrational exuberance” and the housing market’s “signs of froth” were Greenspan’s calling cards — language that left economists and the public parsing his words — Bernanke favors plain terminology.

A believer in keeping inflation at around 2 percent, Bernanke has reached into children’s literature to embrace a “Goldilocks” theory — not too hot, not too cold.

At the confirmation hearing for his previous Fed job in July 2002, Bernanke told the Senate Banking Committee, “Saturation coverage by cable TV networks notwithstanding, the stock market is not the whole economy.”

Bernanke’s approach extends from the world of monetary policy to the local school board. He served two terms as a member of the Montgomery Township Board of Education in New Jersey, not far from Princeton University where he was an economics professor and department chairman.

“He was very good at seeing the big picture and being able to translate a difficult concept into plain English,” said Laurie Navin, who served on the board with Bernanke for six years. “When you’re talking about long-term costs of a contract and, you know, people would be worried about 50 cents and he would be able to explain whether that mattered or not in the long term.”

Friends describe an unassuming man with a wry sense of humor.

After interviewing at the White House for the post on the Fed board, Bernanke sent an e-mail to Navin and other former school board members describing his experience.

“He was so excited … he said, ‘I interviewed with Dick Cheney and George Bush in the Oval Office and they were asking me all these questions and they asked if I had ever served in an elected position, and I said, ‘It may mean nothing here, but I served on my local school board.’ And Bush said, ‘It’s good enough for me, you’re in,”’ according to Navin.

Jamie Savedoff, who also served on the school board with Bernanke, described him as a “very evenhanded, calm, collected, rational person.”

Mark Gertler, chairman of the economics department at New York University who has known Bernanke for 20 years, said he once wore tan socks with a dark suit to a meeting with administration officials.

“He’s a much better dresser now,” Gertler said.

Born in Georgia and raised in Dillon, S.C., Bernanke was an academic star. In sixth grade, he won the state spelling bee but missed higher acclaim when he faltered on the word “edelweiss,” the mountain flower. He got a score of 1,590 on his SAT out of a possible 1,600, taught himself calculus in high school and then focused on economic numbers at Harvard.

He received his doctorate in economics from the Massachusetts Institute of Technology.