Staying alive, but at what cost?

Dying of lung cancer, Carolyn Hobbs tried a new biotechnology drug that produced an unanticipated side effect: acute sticker shock.

She was waiting for her second treatment in a hospital near Denver less than two years ago, when someone from the business office marched in to warn that her share would cost more than $18,000, since the drug wasn’t insured for her type of cancer.

How to decide?

In her six decades, she had shared in a long marriage, raised three children, worked in a nursing home, painted as a hobby — and wasn’t ready to leave it all behind. But she was also a careful spender who sometimes returned new clothes to the store, deciding she didn’t really need them.

Maybe this new drug, Erbitux, could extend her life by a small fraction, but she wouldn’t be cured. “She was just very frugal, and she said it wasn’t worth it,” her husband Larry remembers.

So she refused the treatment.

More patients are confronting this wrenching decision, as the latest generation of pricier cancer drugs and heart implants stretches out the final months of advanced disease. Is the chance for several more months of life — maybe a year or more, with luck — precious enough to spend a small fortune? This dilemma is also challenging governments, employers and insurers, who all help finance America’s longer life spans and innovative technologies.

Extraordinary care for dying patients can make for inspiring medicine, but its extraordinary costs make it an increasingly debated choice to promote public health. Many economists, doctors, and ethicists say this care too often buys too little for too much — and that its expanding share of medical resources might better pay for screening and treating diseases in earlier stages.

Already, up to 30 percent of annual payments by federal Medicare insurance go to the 5 percent of members in their last year of life, research shows.

“People still have an underlying belief that there’s an infinite amount of resources that can be invested in health care,” says Dr. Harlan Krumholz, a Yale University heart specialist who studies quality of care. “But I think we’re coming to a realization that we’re going to need to confront these issues explicitly.”

Maybe so, but any retreat from last-resort care still raises objections from many patients, doctors and medical companies. They denounce “rationing” of care and defend expensive treatments for the dying as a moral imperative.

Who pays?

Within the last decade, an array of expensive new treatments has given some patients their first real fighting chance against common diseases once routinely called “terminal.” These treatments include:

•Cancer drugs manufactured in living cells, instead of beakers. These biotech drugs target just diseased tissue, unlike chemotherapy. Thanks to these drugs, some late-stage colon and blood cancers are no longer hopeless.

•Implants that help the heart pump blood. These devices — the most common is the left-ventricular assist — are heir to decades of research in artificial heart technology. They provide an option for some patients with failing hearts.

Some of these therapies, like the biotech drug Gleevec for leukemia or implanted defibrillators for some heart problems, work wonders in many patients. The trouble with many treatments, though, is that average patients gain only several more months of life, studies have found. A lucky few may survive for years, so many seek treatment in the hope of beating the odds.

“Very few people, when told of a potential life-saving intervention, will not be willing to listen. So the question is now: not whether it will help or not, but who pays?” says Dr. A. Mark Fendrick, at the University of Michigan.

Whoever pays, costs are up. This care costs several times more than the older treatments it supplements or replaces. A last-resort cancer drug can cost up to $50,000 a year — if patients survive that long — with insurance typically picking up at least two-thirds. A mechanical heart pump can cost more than $200,000, with hospital care.

Reports of these breakthroughs, which often fail to mention the price, may have intensified the distinctly American tendency to view death almost as a personal choice, suggest doctors and ethicists.

“I have two small children, and dying right now is not an option,” colon cancer patient Rebecca Dague, of Medina, Ohio, said recently.

Faced with such a disease, more than a third of Americans now would want “everything possible” done to save their lives, up from just over a fifth in 1990, according to a poll by the Pew Research Center for the People and the Press.

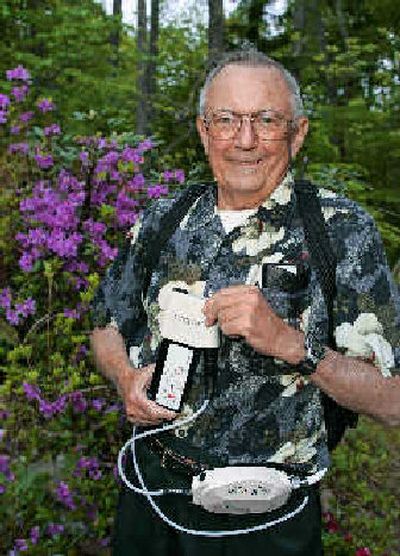

For many on the brink of death, the choice of desperate measures is hardly a choice at all. “It’s better to pay the money than sleeping with the worms,” said Jake Rogers, 62, of Chicago, of his implanted left-ventricular assist device. His doctors implanted a second one in June, when his first wore out after 15 months.

From their first day of medical school, doctors are trained to do their utmost for patients like Rogers. “I think probably there’s more tolerance for high cost at the end of life, when all the options have been exhausted,” says cost analyst Milton Weinstein, at the Harvard School of Public Health. “I think there’s a moral force that causes us to want to do anything we can, irrespective of the cost.”

While doctors advocate for the interest of dying patients, they may also be subtly swayed by earning their livings partly from providing this care. And many patients don’t fret, because they are insulated from huge payouts by insurance.

Robert Graham, 73, of East Brandywine, Pa., chuckled when he heard the high price — up to $250,000 — of heart pumps like the one implanted in him last November. It was covered by insurance.

“I got to live a long time to be worth that!” he said. Yet the average patient in the best medical test so far lived less than nine more months.

Federal safety regulators do not regulate the price of end-of-life treatments. They evaluate only if drugs or devices work, not how well they work for their prices.

Medicare, which insures about 80 percent of dying Americans, makes no acknowledged evaluation of cost in deciding what to cover. It is not allowed to negotiate for lower drug prices. Its coverage umbrella sets a standard for private insurers.

Under such pressures, the $1.9 trillion spent on U.S. health care in 2004 will balloon to $4 trillion by 2015, federal forecasters project.

Enough is enough

Choices are being made every day, case by case.

Some insurers refuse to cover a treatment. Doctors send patients home to die, sometimes out of mercy. Some patients say enough is enough.

Dr. David Johnson, at Nashville’s Vanderbilt-Ingram Cancer Center in Tennessee, pitched Erbitux to his brother-in-law, a 57-year-old married truck driver with advanced colon cancer. However, the drug has barely been proven to extend average survival at all.

The doctor remembers his brother-in-law refusing and saying: “Are you stupid? I’m not giving up my limited resources.”

The drug’s marketer, Bristol-Myers Squibb, did not reply to repeated requests for comment.

Employers and insurers are discreetly controlling costs through premiums, deductibles, co-payments, caps, and even outright exclusions. “Benefit costs would go through the roof if there were no considerations given to the costs,” says Karen Ignagni, president of the trade group America’s Health Insurance Plans.

Despite official denials, the federal Medicare program makes subtle cost evaluations, says Dr. William Maisel, a Boston heart specialist who chairs a federal committee on cardiac devices. “I think they are concerned about people using the term ‘rationing’ or ‘withholding therapies,’ ” says Maisel, at Beth Israel Deaconess Medical Center.

One way to control costs, without saying “no,” is to keep reimbursements low. For example, Medicare’s $140,000 reimbursement last year for heart pumps is widely acknowledged as below-market.

“We can’t say, ‘no,’ explicitly. We say, ‘yes, but,’ ” explains Peter Neumann, who runs a Tufts University center on medical cost-effectiveness in Boston.

Yes, but start with a cheaper drug, get prior authorization, or make a bigger co-payment.

Or, for the 45 million uninsured: Yes, but go to the emergency room and rely on charity for extended care. The nonprofit Patient Advocate Foundation reports that nearly half of its cases or requests for help involved co-payments last year, up from just 5 percent in 2002.

“If you’ve got a thick wallet or a full purse, you can get any care you want. If you don’t, there’s rationing for you,” says former U.S. Health Secretary Joseph Califano, who later dealt with escalating health costs as a board member at Chrysler Corp.

“We’re going to have to think very hard about how to provide some of these truly exotic treatments,” he adds.