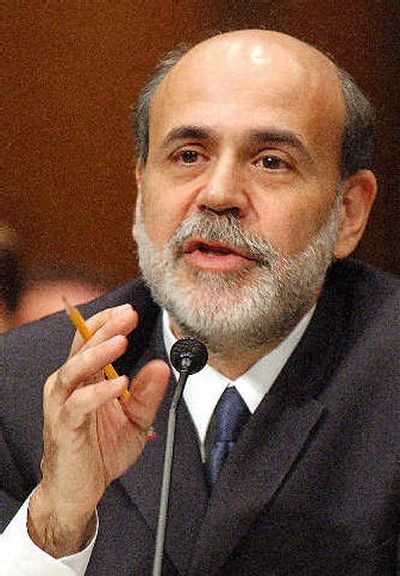

Bernanke takes spotlight

WASHINGTON — The eyes of world financial markets will be on Ben Bernanke when the new chairman of the Federal Reserve makes his first public statement today on the state of the U.S. economy and the future of interest rate policy.

His debut before Congress, and the cameras, could affect Americans in many ways. It could spook or rally stock and bond markets and even affect housing prices.

Bernanke, who assumed his post after Alan Greenspan retired Jan. 31, will present the Fed’s semiannual monetary-policy report to the House Financial Services Committee today and the Senate Banking Committee on Thursday. Awaiting his testimony, financial markets are skittish about an unknown figure leading the Fed for the first time in 18 1/2 years.

Bernanke said in his confirmation hearing that he’d be more clear and open than Greenspan, who often was deliberately vague. Now people want to know Bernanke’s views on everything from inflation threats to the apparent housing slowdown to signals from the bond market that the entire U.S. economy may be decelerating. Every word he utters will be scrutinized.

As Greenspan left office, he pushed through a 14th consecutive quarter-point interest rate hike, bringing short-term rates to 4.5 percent, a benchmark that influences bank loans. The Fed has been tightening credit since June 2004.

Now it’s up to Bernanke to decide where interest rates should be. Push them higher to curb inflation and the economy may tip into recession. Leave them steady or cut them and inflation might ignite, eroding the value of money and distorting investment decisions.

Many economists worry that Bernanke may be more tolerant of inflation than Greenspan was, and think that Bernanke must prove himself as an inflation fighter. Toward that end, they expect him to notch another quarter-point interest-rate hike, to 4.75 percent, when the Fed’s policy-making Open Market Committee meets again March 28-29.

But the road ahead is unclear. Traditional economic indicators are mixed.

“The economy is strong, and if history is a guide it should suggest inflationary pressures should develop, but they haven’t,” said Mark Zandi, the chief economist for Moody’s Economy.com, an economic consultancy in West Chester, Pa. “Given the crosscurrents in the economic inflation data, it will difficult for him to be clear-cut.”

At the same time, long-term rates for Treasury bonds are lower than short-term rates. That’s a reversal of the norm; economists call it an “inverted yield curve.” Historically it’s been a good predictor of an economic slowdown; it’s preceded the last four recessions.

Long-term rates remain relatively low largely because foreign money keeps flooding into American investments, so the inverted curve may not mean as much as it used to. Economists aren’t sure. But if Bernanke pushes short rates higher, it would invert the curve more.