Crude awakening: Oil hits $78 a barrel

WASHINGTON — Oil’s march toward $80 a barrel seems inevitable, with multiple paths to get there.

It could follow another flare-up of Middle East violence. Or a hurricane in the Gulf of Mexico. Or maybe a refinery snag is all it would take.

“Mother Nature, physical disruptions and the politics of the world. All of those tell you that the risks are toward the upside,” said Larry Goldstein, president of the Petroleum Industry Research Foundation, a New York-based industry-financed think tank.

Oil prices surged Thursday to a record above $78 a barrel in world markets agitated by the escalating Israel-Lebanon conflict and the threat of supply disruptions in the Middle East and beyond.

There is enough crude oil to meet daily demand of 85 million barrels a day, but it isn’t just buyers of the physical commodity bidding up prices. Hedge funds and other institutional investors are making big bets on energy as a way to profit from global instability and to offset any losses the rest of their portfolios may sustain as a result.

“Oil has become a proxy for geopolitics right now,” said Daniel Yergin, who heads Cambridge Energy Research Associates.

Yergin said petroleum supply-demand fundamentals are improving, with global oil inventories and spare oil-production capacity rising, but clearly not enough to offset the geopolitical unrest.

The latest leap in oil has shaken the confidence of stock-market investors already fretting about higher interest rates and a slowing economy, though economists say most U.S. consumers and businesses appear to be absorbing higher energy costs surprisingly well.

U.S. gasoline demand continues to rise in spite of near $3-a-gallon pump prices, core inflation remains relatively low and the U.S. economy, while cooling off, is still forecast to grow by roughly 3 percent in the second half of the year.

“Two years ago I might have said that $70 or $75 a barrel would be some kind of a tipping point. Now I’m not so sure anymore,” said Nariman Behravesh, chief economist at Global Insight, a private forecasting firm.

Still, Behravesh said lower-income Americans are suffering disproportionately from higher energy costs and “I could certainly make a policy case for helping them out on a temporary basis.”

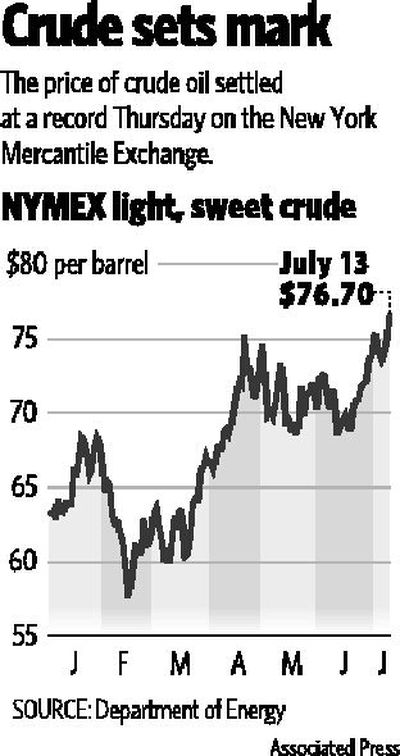

Light sweet crude for August delivery settled at a new high of $76.70 a barrel on the New York Mercantile Exchange, then continued climbing in after-hours electronic trading — when trading volume is significantly lower — to $78.35. The rally came as fighting between Israel and Lebanon intensified, explosions hit Nigerian oil installations and a diplomatic standoff dragged on between the West and Iran over its nuclear program.

The previous Nymex settlement record of $75.19 was set July 5. The previous intraday record of $75.78 was posted two days later.

In London, Brent crude futures soared as high as $76.95 a barrel before settling at a record $76.69, an increase of $2.30.

Adjusted for inflation, oil prices would need to rise to about $90 a barrel to exceed the highs set a quarter century ago when supplies tightened in the aftermath of a revolution in Iran and a war between Iraq and Iran.

Today, oil prices are being pushed higher by rising global demand and worries that the world’s limited supply cushion would not be adequate to offset a lengthy disruption to output in major producing countries, such as Iran or Nigeria. There are also concerns about the risks hurricanes pose to U.S. production.

The latest fear being priced into the market is that the conflict between Israel and Lebanon could spill over into other corners of the Middle East, the region that produces nearly a third the world’s oil and contains almost two-thirds of its untapped reserves.

Israel intensified its attacks against Lebanon on Thursday, imposing a naval blockade, twice hitting Beirut’s airport and blasting two Lebanese army air bases near Syria. Hezbollah fired more than 100 rockets into Israel, which said one also struck the port city of Haifa. More than 51 people have died in two days of violence following the capture of two Israeli soldiers by Hezbollah militants, who have financial links to Syria and Iran.

Iran has threatened on more than one occasion to use oil as a weapon if the United Nations uses economic sanctions or some other punishment in its dispute with Tehran over its nuclear program. While OPEC’s No. 2 supplier has not raised the issue of withholding oil from the market in a sign of solidarity with Hezbollah, the possibility is no doubt influencing oil traders’ actions.

“It plays psychologically in people’s minds,” said Larry Goldstein, president of the Petroleum Industry Research Foundation, a New York-based industry-financed think tank. “You don’t have to hear them say it.”