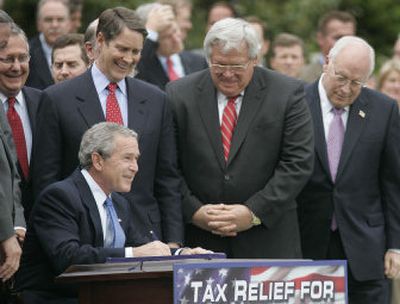

Bush signs tax cut extensions

WASHINGTON – President Bush signed a $70 billion tax-cut bill on Wednesday that Republicans hope will help them with voters as they head into the fall elections with worries about retaining control of Congress.

“With this bill, we’re sending the American people a clear message about our policy,” Bush said. “We’re going to continue to trust the American people with their own money.”

Democrats overwhelmingly opposed the legislation, saying the tax cuts on capital gains and dividends will flow mostly to the rich.

“Today’s really a good day to be a millionaire, but it’s a bad day if you want to be a millionaire,” said Senate Minority Leader Harry Reid of Nevada. “That’s because President Bush just signed, with the stroke of a pen, a bill that sealed the fate of those trying to get ahead.”

The GOP says the tax cuts, first enacted in 2003, have created 5.2 million jobs since August 2003 and bolstered tax revenue by nearly 15 percent last year. According to the White House, the cuts have helped spur growth by keeping $880 billion in taxpayers’ pockets during the past five years.

The legislation provides a two-year extension of the reduced 15 percent tax rate for capital gains and dividends; it was to expire at the end of 2008.

Since 2003 when the cuts were passed, business investment has been growing at more than 9 percent a year and spending on equipment and software has hit record levels, Bush said.

The measure also extends for one year recent changes to the alternative minimum tax to prevent that tax from ensnaring more upper middle-income families. The tax was designed to hit the very wealthy. Now, however, it is common for taxpayers, especially those with families in high-tax states, to pay the AMT on incomes of $100,000 and more.

The GOP sees the extensions as a chance to raise approval ratings for the president and the Republican-controlled Congress. Public opinion surveys put the ratings at their lowest points in the Bush presidency.

Democrats say the cuts favor the wealthy and even oil companies. They point to other tax breaks that languished in the Senate and expired in December: breaks for college tuition, state and local sales taxes, and research and development.

“Two words were missing when the president spoke at the signing ceremony: ‘middle class,’ ” said Sen. Chuck Schumer, D-N.Y. “Even though there is a cut for middle class in the AMT – although not close to a big enough one – the president didn’t mention it.

“He only talked about the tax cuts for the very wealthy.”