States risk defaults of mortgages

NEW YORK – State treasurers from Florida to Maine to Montana have found themselves in the awkward position this past week of having to explain why they parked taxpayer money in some of the most opaque investments on Wall Street.

More than a dozen state-run cash pools that manage money for local governments have some exposure to mortgage-related and other high-risk holdings that roiled credit markets this past summer, according to rating agency Standard & Poor’s.

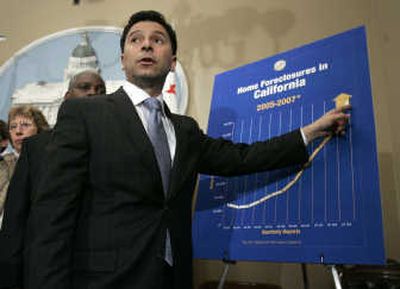

The fear now is that the same subprime-mortgage turmoil that triggered multibillion-dollar writedowns for Wall Street’s biggest banks might trickle down to teachers, civil servants and even the vendors delivering supplies to schools because of the way public funds were invested.

Troubles first emerged as Florida officials disclosed their $27 billion investment pool had about $2 billion sunk into subprime-tainted debt – and $725 million of that had already defaulted. Local governments rushed to withdraw about $13 billion from the battered fund, and there are worries similar runs might happen elsewhere.

State finance officials that did invest in mortgage-related instruments say they were lured by the sterling credit ratings of the issues and a promise of a 2 percentage point or higher return than could be earned on three-month U.S. Treasury bills, which now yield about 3 percent.

“We relied on professional advice from our brokers and rating agencies,” said Maine State Treasurer David Lemoine. “And then there’s an unprecedented collapses of a super-highly rated investment almost overnight.”

Maine – and others like Connecticut, Florida, Montana and King County in Washington – were drawn to the highly rated commercial paper issued by an a structured investment vehicle, or SIV, called Mainsail II that was operated by British hedge fund Solent Capital Partners. Mainsail’s commercial paper offerings were later downgraded to junk by rating agencies because of concerns about whether the SIVs could repay the money it owed.