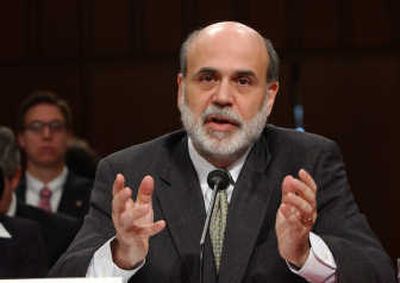

Bernanke sees slower growth

WASHINGTON – Federal Reserve Chairman Ben Bernanke said Thursday that economic growth will slow noticeably in coming months while surging oil costs will raise inflation pressures. But he said the economy is nowhere close to the stagflation nightmare of the 1970s and he predicted an economic rebound by mid-2008.

Testifying before the Joint Economic Committee, Bernanke acknowledged a host of problems facing the economy, from a deeper-than-expected housing slump to a lingering credit crunch and now sharply rising oil prices and a falling value of the dollar, both of which increase inflation threats.

Bernanke stressed that the central bank, which has cut a key interest rate twice over the past two months, was watching developments and would be prepared to respond as needed. However, he emphasized that the central bank believes economic risks are roughly balanced between the threats of weaker growth and higher inflation.

That was the stance the Fed took last week when it trimmed its federal funds rate, the interest banks charge each other, by a quarter-point to 4.5 percent following a bolder half-point cut in September.

The Fed sent a clear signal that last week’s rate cut may be all that is needed to deal with the economy’s problems, a disclosure that sent financial markets into a slump that has deepened as a number of corporate giants – including General Motors, Citicorp and Merrill Lynch – have announced huge losses in recent days.

“The stock market had been hoping that the Fed chairman would hold out some promise of another rate cut, but instead he emphasized the risks of inflation,” said David Jones, chief economist at DMJ Advisors.

After falling by as much as 200 points, the Dow Jones industrial average closed out another difficult trading session down 33.73 points at 13,266.29. That decline followed a 360.92-point plunge on Wednesday, which had been the third drop of more than 350 points in the past month.

Economists said Bernanke’s noncommittal tone on further rate cuts could have been influenced by worries about a sharp plunge in the value of the dollar against other currencies, a fall that has accelerated since the Fed began cutting rates. Lower U.S. interest rates make foreigners less interested in holding dollar-denominated assets such as stocks and bonds.

But many analysts said they were still looking for the central bank to cut rates again in December or January, because they believe the economy will have slowed so much by that time that the Fed will need to boost activity to prevent a recession.

“Bernanke may not have his finger on the easing trigger, but he likely won’t hesitate to squeeze again if … the economy weakens more than anticipated,” said Sal Guatieri, senior economist at BMO Capital Markets.

Bernanke said he and his colleagues believe economic activity will “slow noticeably in the fourth quarter” compared with the 3.9 percent pace of the third quarter Many analysts believe growth could be as weak as 1.5 percent in the current quarter.

“Growth was seen as remaining sluggish during the first part of next year, then strengthening as the effects of tighter credit and the housing correction begin to wane,” Bernanke said.

Bernanke acknowledged the recent market turmoil, but he generally took a more upbeat view of how things will play out. While acknowledging there were risks, he said recent economic data showed the economy had “remained resilient.”

But many members of the JEC panel took issue with that assessment, saying the renewed turmoil in financial markets was pointing to greater dangers ahead with the risks of a recession rising.

“I think we are at a moment of economic crisis,” Sen. Charles Schumer, D-N.Y., told Bernanke. “I’m not surprised to hear experts, such as your predecessor Alan Greenspan, warn about the threat of a recession. I have begun to worry about it too.”

Rep. Maurice Hinchey, D-N.Y., said the array of problems facing the economy – from slowing growth to soaring oil prices and rising inflation – reminded him of the “stagflation” that gripped the country during the oil shocks of the 1970s.

But Bernanke disagreed with that assessment, saying that while the Fed was expecting a period of slower growth and inflation risks from higher energy prices, “We don’t see anything approaching the period of the 1970s.”

Several lawmakers questioned whether the Fed was doing all it could to deal with an expected wave of mortgage foreclosures.

Bernanke said the administration, the Fed and other banking regulators were working to get mortgage lenders to move more aggressively to work with borrowers to help them refinance to more affordable mortgages and avoid losing their homes.