VMware builds on the buzz

SAN FRANCISCO — Fresh off this year’s hottest debut on Wall Street, trendsetting software maker VMware Inc. is hosting nearly 11,000 people clamoring to learn more about a computing twist that is turning into high-tech’s next big jackpot.

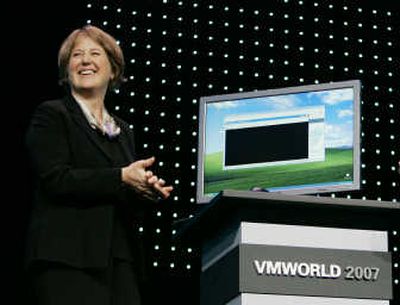

VMware’s three-day conference, which began Tuesday in San Francisco, provides the once-obscure company with an opportunity to build on the buzz created by its lucrative initial public offering of stock less than a month ago.

“This is their moment in the sun,” said Erik Josowitz, vice president of product strategy of Surgient Inc., one of many software makers hoping to ride VMWare’s coattails. “They have every reason to be having a very big party right now.”

VMware’s software steers a process known as “virtualization,” which allows computers to harness more of their unused power and run more applications at once without a hiccup. More than 20,000 companies already use VMware’s software.

Investors are flocking to VMware too. The Palo Alto-based company’s initial public offering raised $1.1 billion, the most a high-tech company has pulled in since Internet search leader Google Inc. went public three years ago.

VMware’s stockholders have enjoyed the ride as shares have nearly tripled from their initial price of $29. The stock hit a new high of $82.75 Tuesday before finishing the regular trading session at $76.65.

With a market value approaching $30 billion, VMware already is worth more than all but three publicly traded software makers — Microsoft Corp., Oracle Corp. and SAP AG.

In January 2004, VMware was valued at $602 million — the price EMC paid for it then. Hopkinton, Mass.-based EMC still holds an 87 percent stake in the company.

This week’s conference, dubbed “VMworld,” is another reminder of the company’s rapid ascent. VMware’s first customer conference in 2004 drew fewer than 1,500 people.

The central idea of WMware’s visualization software is to turn a single computer into the equivalent of multiple machines, enabling companies to save money on the hardware and electricity needed to keep their data centers humming. Virtualization also is supposed to make it easier to recover information after computers crash.

Those benefits are expected to spur one of corporate America’s biggest spending sprees on technology since the dot-com boom ended in 2000. Research firm IDC estimates spending on virtualization software and supporting services will swell to more than $15 billion worldwide in 2011, up from $6.5 billion last year. Billions more will likely be spent on compatible equipment.

“Virtualization has reached a tipping point,” Hector Ruiz, Advanced Micro Devices Inc.’s chief executive officer, said during a speech at the conference Tuesday.

Forrester Research analyst Frank Gillett agreed. “We are about to see a big shift in information technology. It’s like the light bulbs are going off in everyone’s heads all at once.”

Computer chip maker AMD is angling for a piece of the action, along with a long list of technology bellwethers, including Intel Corp., Hewlett-Packard Co., IBM Corp., Dell Inc. and Cisco Systems Inc.

None appears better positioned than VMware, which was founded in 1998 by entrepreneur Diane Greene and her husband, Stanford University associate professor Mendel Rosenblum. Greene remains VMware’s chief executive and Rosenblum serves as chief technical officer.

Analysts predict VMware will earn $235 million on revenue of $1.27 billion this year, up from a profit of $86 million on revenue of $704 million last year. The company’s growth prompted both Intel and Cisco to buy small stakes in VMware before the IPO.