Expect stimulus checks in May

WASHINGTON – The checks aren’t in the mail, but they will be soon.

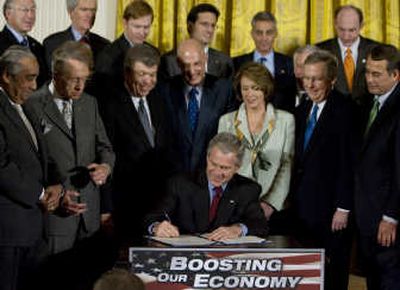

President Bush signed legislation Wednesday to rush rebates to millions of people, the centerpiece of government efforts to brace the wobbly economy. Most taxpayers will receive a check of up to $600 for individuals and $1,200 for couples, with an additional $300 for each child.

More than 130 million people are expected to get the rebates, starting around May. Congress, Bush, the Federal Reserve and Wall Street are hoping the money will burn such a hole in people’s pockets that they won’t be able to resist spending it. And the spending is supposed to give an energizing jolt to a national economy that is in danger of toppling into a recession if it hasn’t already.

The measure Bush signed – a $168 billion rescue package passed with lightning speed by Congress last week – includes not only rebates for individuals but also tax breaks for businesses to spur investment in new plants and equipment. The package also contains provisions aimed at helping struggling homeowners clobbered by the housing collapse and the credit crunch refinance into more affordable mortgages.

Here’s a closer look at how the rebates will work.

Q. Who qualifies for a rebate check?

A. Individual tax filers with earned incomes above $3,000 but less than $75,000 in 2007 will receive $300 to $600 checks. For joint filers with adjusted gross incomes up to $150,000, the checks range from $600 to $1,200. For filers with children who have valid Social Security numbers, there also will be rebates of $300 per child.

Because of an omission when the bill was drafted, the Internal Revenue Service can’t say yet whether the cutoff to qualify for child tax rebates is children who turned 17 in 2007 or in 2008. The answer is expected later this week.

Q. What if my/our income exceeds the caps?

A. There will be partial rebates for higher adjusted gross incomes, up to $87,000 for individual filers and $174,000 for joint filers. In a small number of cases, filers with incomes above those thresholds who have children may qualify for some rebate.

Q. What if I don’t have earned income?

A. For Americans who live on benefit checks from Social Security or the Department of Veterans Affairs, and for some retired railway workers, there will be refund checks of $300 as long as the sum of their benefit checks in 2007 exceeded $3,000.

Q. What if I collected benefits for only part of 2007?

A. Multiply the benefit by the number of months you received it to see whether the sum exceeds $3,000. If it does, you get a $300 check; if it doesn’t, you don’t.

Q. What must I do to get my stimulus check?

A. Most Americans need only file their usual 2007 tax paperwork before the April 15 deadline. The IRS will calculate what you get and send a letter in advance. Filers who provide bank-routing information to get their usual tax-refund checks electronically will get their stimulus checks first.

People living off Social Security or Veterans Affairs checks who usually don’t file tax documents must file 1040 or 1040A tax forms this year to receive the stimulus checks. They’ll have to file their names, addresses and, most importantly, valid Social Security numbers.

Q. Will this check count against my tax refund next year?

A. No. The stimulus checks won’t be treated as taxable income in 2008, nor will they be treated as early refunds subtracted from the 2008 tax year. They’re bonus checks whose value is determined by the adjusted gross income on 2007 tax returns.

Q. When will the checks go out?

A. By mid-May, the IRS hopes.

Q. What if I file for an extension of the April 15 tax deadline?

A. Your rebate check will be delayed until you file your tax documents. You have until Dec. 31 to file tax paperwork and still get a stimulus check.

Q. If I’ve taken out a refund anticipation loan from a tax preparer, will this affect my stimulus check?

A. Filers who’ve taken out refund anticipation loans for their regular 2007 taxes won’t qualify for electronic deposits of their stimulus checks and instead will receive them later by mail.

Q. Who doesn’t qualify for a stimulus check?

A. Anyone who can’t legally obtain a Social Security number. That would include immigrants with I-10 tax ID numbers from the Treasury Department. College students who’re counted on their parents’ tax returns as dependents also won’t qualify.

Q. How much are these stimulus checks costing the government?

A. Tax filers will receive rebates worth $100 billion to $110 billion. The IRS has been given another $202 million to help get the checks out quickly. Treasury’s financial services management, which will disburse the checks, will get an extra $64 million. The Social Security Administration will receive about $31 million to conduct an outreach effort to help seniors and people with disabilities apply for checks.

Some examples on how tax rebates will differ by income and filing status can be found at www.treas.gov/press/releases/reports/fact%20sheet%20examples.pdf.