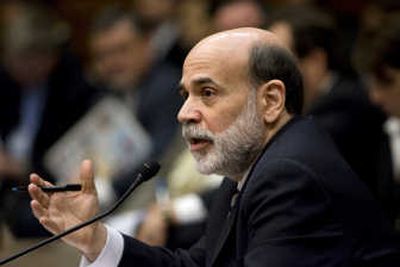

Bernanke says economy is Fed’s top priority

WASHINGTON – Ben Bernanke is picking his fights, and for now that means trying to save the fragile economy rather than going after inflation.

The Federal Reserve is ready to lower interest rates again to brace the wobbly economy even as zooming oil prices spread inflation, the Fed chairman signaled to Congress on Wednesday.

Battling cross-currents, Bernanke must make a choice: keep the economy afloat after mighty blows from the housing and credit crises or focus instead on the threat of future price increases.

For now, the No. 1 job is shoring up the economy, Bernanke suggested in an appearance before the House Financial Services Committee. He pledged anew to slice a key interest rate and help the economy, which many fear is on the verge of a recession if not already in one.

“The economic situation has become distinctly less favorable” since the summer, the Fed chief told lawmakers.

Since that time, the housing slump has worsened, credit problems have intensified and the job market has deteriorated. Bernanke said that combination of bad news has made people and businesses more cautious about spending and investing – further weakening the economy.

The country should prepare for “sluggish economic activity in the near term,” Bernanke said. Concern is growing about the possible return of stagflation, when stagnant growth is combined with rising inflation, for the first time since the 1970s.

Were energy prices to continue to rise at a sharp clip – something the Fed does not anticipate – inflation would spread and growth would be further restrained, he said. If that happened, it would be a “very tough situation,” he added.

The Fed is prepared to lower rates again to bolster economic growth, Bernanke said. The Fed “will act in a timely manner as needed to support growth and to provide adequate insurance against downside risks,” he said, sticking closely to assurances he offered earlier this month.

The central bank started lowering a key interest rate in September. Over just eight days in January, the Fed shaved 1.25 percentage points, the biggest one-month reduction in a quarter-century. Economists and Wall Street investors predict the Fed will cut rates again at its next meeting, March 18. Some analysts believe rates will drop again in April.

Brian Bethune, economist at Global Insight, said Bernanke’s remarks “keeps the door wide open for further rate cuts.”

Bernanke said at some point this year, the Fed will need to “assess whether the stance of monetary policy is properly calibrated” to foster the Fed’s objectives of price stability “in an environment of downside risks to growth.”

He was hopeful that previous rate reductions and the $168 billion economic aid plan of tax rebates for people and tax breaks for business would energize the economy in the second half of 2008.

Bernanke was asked when he thought the housing market might stabilize. It’s possible, he said, that by “later this year it will stop being such a big drag directly” on the economy. But home prices probably will decline into next year, he added.

“It is very difficult to know, and we’ve been wrong before,” Bernanke said.