Gold prices soar on rising oil cost

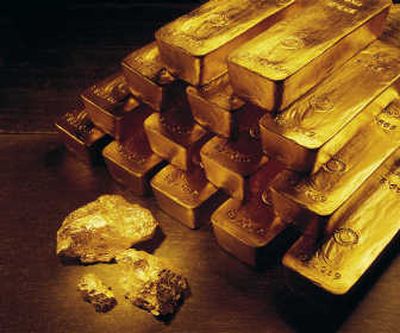

NEW YORK – It’s the stuff of Western dramas in which rugged men went looking for it in the mountains. It’s the glittering metal used in fancy jewelry, the highest honors for sports and the bars tucked away in safes. And these days, gold’s appeal as a safe-haven investment has carried it to record prices.

Gold futures surged above $880 Tuesday to their highest level ever, not accounting for inflation, propelled higher by rising oil prices and a weak U.S. dollar.

An ounce of gold for February delivery climbed as high as $884 on the New York Mercantile Exchange, topping by almost $10 its previous record of $875 set in 1980, and later settled at $880.30, up $18.30.

Market analysts who have watched gold’s ascent weren’t surprised that gold had reached a new high.

“I’m telling my friends,” said Ashraf Laidi, an analyst at CMC Markets. “I’ve told them for the past three years to invest in gold.”

Still, when adjusted for inflation, gold remains far short of the jaw-dropping levels of 28 years ago. An ounce of gold at $875 in 1980 would be worth from $2,115 to $2,200 today.

Gold that cost $650 an ounce in January 2007 has soared during the past year on rising prices for oil and other commodities and also by the falling U.S. dollar.

Those trends have increased the metal’s appeal as a hedge against inflation. Gold is also seen as a safe investment in times of political and economic uncertainty around the world.

Hedge and pension funds, along with other long-term investors, also flocked to gold as the mortgage and credit crisis in the U.S. intensified.

Few signs have appeared of the frenzy that surrounded the metal’s last record-setting foray, but today’s jewelry prices do reflect the sharp run-up in precious metals prices over the past few months.

As Valentine’s Day approaches, shoppers might not be so sweet on rising price tags, and choose to settle for a smaller or lighter pair of gold earrings.

Dealers in Manhattan’s midtown Diamond District, however, said they’ve seen worse.

Michael Pacicco runs his family-founded Pacicco & Pacicco Inc. from a windowless, second-floor shop on West 47th Street, its display cases filled with custom-made gold pieces from crosses to bracelets.

A few hours after gold hit its peak around $880 an ounce, he said a rush to sell gold jewelry in the Diamond District was “nonexistent” compared to the long lines of people winding around the block to Fifth Avenue hawking their jewels in 1980, when gold hit $875 an ounce. Some people even brought their gold fillings.

“I don’t think people have as much gold now as they did then,” he said, explaining that when the precious metal sold for $100 or $200 an ounce, it was easier to buy a bracelet or a ring than in recent times, with the economy heading for a crunch.