WaMu replaces chairman

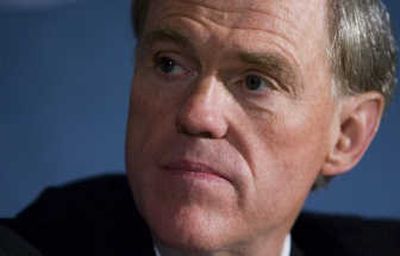

SEATTLE – Washington Mutual Corp., hard-hit by the mortgage and credit crises, said Monday it will replace Chief Executive Kerry Killinger as chairman of the board and take other steps to improve corporate governance.

Killinger, 58, will remain on the board where he has served as chairman of the country’s largest savings and loan since 1991. He will also hold his post as chief executive, even as the list of CEOs shown the door at the country’s top banks continues to grow.

Wachovia Corp. said Monday it had asked CEO Ken Thompson to step down, joining Merrill Lynch & Co.’s Stanley O’Neal and Citigroup Inc.’s Charles Prince among the ousted.

At WaMu’s April shareholders meeting, a nonbinding resolution urging the installation of a non-employee as board chairman passed with 51.5 percent of the votes.

WaMu said Stephen E. Frank, the lead director on its board, will become chairman starting July 1. Frank, 66, retired in 2002 as CEO of Southern California Edison, the largest subsidiary of the Edison International power company.

In addition to splitting the job of chairman and CEO, WaMu said its board made has made it harder for directors in uncontested elections to hold their seats if they don’t get a majority of the votes.

The board also shuffled the leadership for committees that some shareholders blamed for heavily exposing the thrift to the subprime mortgage crisis, despite signs that the housing market was teetering on collapse.

WaMu said it took appropriate steps early on to mitigate risks to questionable mortgages, but in April the chair of its finance committee, Mary Pugh, resigned.

Orin C. Smith was named to replace Pugh on Monday. David Bonderman, managing director of TPG, a private equity group that led a $7 billion investment in WaMu this spring, will serve as vice chair of the committee.

Another bank rattled by the subprime crisis, Britain’s Bradford & Bingley, announced Monday that TPG had acquired nearly a quarter of its shares.

WaMu also swapped out the chairs of its governance committee and its corporate relations committee and said it is searching for additional directors.

“These actions underscore the board’s long-standing commitment to good corporate governance and my personal commitment to improving the company’s financial performance and delivering value to our shareholders,” Killinger said in a statement.

Washington Mutual has been badly hurt by rising mortgage delinquencies or defaults and by the sinking value of its mortgage portfolio. During the first quarter, WaMu lost more than $1.1 billion and set aside $3.5 billion to cover defaulted loans.

Shares of WaMu slipped 2 cents to $9.