Fed to buy corporate debt, possibly cut interest rates

Reassurances do nothing to stem investors’ fears

WASHINGTON – The Federal Reserve said Tuesday it would become a lender of last resort to corporate America and signaled a possible interest rate cut, but the stock market nose-dived again as the financial crisis continued to defy the best efforts of policymakers.

Normally, even a hint of easier credit would have been enough to rally markets, especially when coupled with the Fed’s apparently unprecedented decision to purchase as much as hundreds of billions of dollars of short-term corporate debt – the loans businesses count on to fuel daily operations but now have trouble getting because of the credit freeze-up.

But these are not normal times, and after a brief morning rise, the Dow Jones industrial average market bumped steadily downward, losing 508.39 points, or 5.1 percent, to close at 9,447.11.

Federal Reserve Chairman Ben Bernanke hinted that the central bank would weigh an interest rate cut perhaps before the next scheduled meeting at the end of the month. But even as he promised to continue using all the power at his disposal, he offered a grim assessment of the road ahead.

“The heightened financial turmoil that we have experienced of late may well lengthen the period of weak economic performance and further increase the risks to growth,” he said.

The Fed’s announcement that it would enter the market for short-term commercial paper was credited with an immediate easing of conditions in some parts of that market, which supplies funds for such basic corporate needs as meeting payrolls and financing inventories.

Nonetheless, some observers are questioning whether the government is spreading itself too thin.

“Everyone knows they can’t save everybody,” said Carol Miller, manager of the Federated Capital Appreciation fund.

The government’s various rescue efforts, including the $700 billion plan passed by Congress last week, are still in the planning stages and will not begin operation for several weeks.

Senior Fed officials said the aim of the commercial paper program is to rebuild the confidence of money-market mutual fund operators who usually buy much of the short-term debt issued by American corporations. In recent days, they said, even solvent companies have not been able to issue debt with terms longer than a day or two.

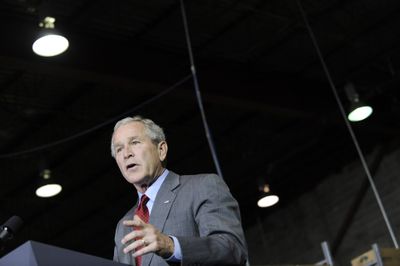

For his part, President Bush tried to sound a reassuring note while acknowledging the crisis.

“Right now we’re in tough, tough times, no question about it,” Bush said as he paid a visit to Guernsey Office Products in Chantilly, Va. “But you can’t convince me that in the long run, that we’re not going to get back on our feet again. And if anybody ever says that, they don’t understand the American spirit.”

“No question, in the short term … the value of your 401(k), if you’re in stocks, is going to go down,” Bush said. “I wish I could snap my fingers and make what happened stop. But that’s not the way it works.”

“Let’s give this time,” he added. “Let’s give this plan time to get these credit markets eased up so that normal business can begin.”