Fed officials encourage bailout program overhaul

Some funds would be dedicated to prevent foreclosures

WASHINGTON – Top officials of the Federal Reserve Tuesday pushed for more money and a revamped approach to the rescue of the financial system, arguing that tax cuts and a government stimulus program are not enough to contain a deep recession.

The Fed leaders spoke as President-elect Barack Obama worked Capitol Hill, trying to persuade Democratic senators not to block a request for the last $350 billion of the bailout funds and assuring them that he is willing to use his veto power if they do so, according to participants in his lunchtime meeting with lawmakers.

Obama added that he would prefer to avoid making a politically awkward veto against a Democratic Congress one of his first official acts as president.

In laying out their ideas on how to disburse funds from the second half of the $700 billion financial rescue program, Fed leaders offered a more detailed vision than have aides to Obama. Lawmakers on both sides of the aisle have voiced consternation and even anger that they have not been given more specifics on how the money would be used.

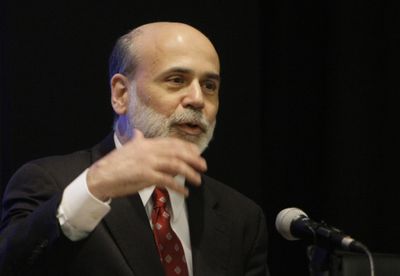

Among other steps, Federal Reserve chairman Ben Bernanke and vice chairman Donald Kohn suggested taking troubled assets off the books of banks – a strategy Fed officials backed before it was abandoned months ago – and also using some of the money to help people at risk of foreclosure.

Bernanke, in a speech in London, argued that “fiscal actions are unlikely to promote a lasting recovery unless they are accompanied by strong measures to further stabilize and strengthen the financial system.”

His speech, along with separate congressional testimony Tuesday by Kohn, amounted to an aggressive new pitch to Congress for more money for the financial rescue, known as the Troubled Asset Relief Program. Although it’s an independent agency, the Fed has a consultative role in deploying the money, and Kohn has represented the Fed in conversations with the Obama transition team on how to use the cash.