Global finance leaders seeing signs of stability

G-8 members agree to seek joint regulatory principles

Financial chiefs from the Group of Eight industrialized nations Saturday offered their most optimistic assessment yet of the global crisis, noting encouraging signs of economic stabilization and calling for an “exit strategy” from the policies that have been used to stimulate growth around the world.

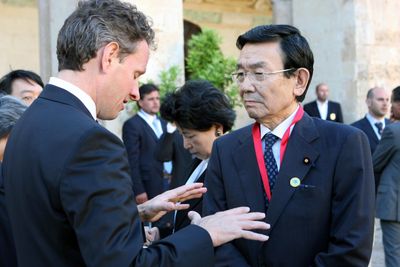

Following two days of meetings in Lecce, Italy, the eight finance ministers – including Treasury Secretary Timothy F. Geithner and his counterparts from Britain, France, Germany, Italy, Canada, Japan and Russia – also agreed to create “a set of common principles and standards governing the conduct of international business and finance.”

The strategy for obtaining those goals, they said in a communiqué, would be known going forward as “the Lecce Framework,” with the objective of identifying and filling in the regulatory gaps that helped cause the current crisis. Geithner, in particular, called on international banking regulators to this year map out better ways to “quickly resolve failures of cross-border financial firms.”

In Europe, officials have already moved to adopt new measures for more rigorous oversight of rating agencies and companies selling securitized assets. Geithner pledged the United States would offer its own broad proposals for “more conservative standards” when it unveils a much-anticipated reform plan to overhaul domestic financial regulation this week.

Treasury officials said Saturday that plan will include measures to set tougher capital standards and oversight for banks, better coordinate oversight of global financial institutions, and improve monitoring and transparency in global derivatives markets.

“Because risk does not respect borders, we will put forward several international proposals in our reform package to help raise standards globally,” Geithner said in Lecce on Saturday.

Financial chiefs expressed cautious optimism on the global economy, pointing to the recent rebound in stock markets and a spate of encouraging economic data. Signs of a bottoming out of the crisis are particularly strong in the United States and China. Officials said, however, that significant risks remain.