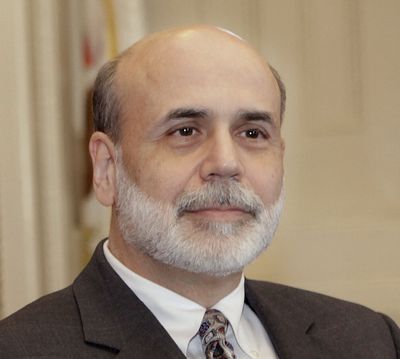

Bernanke spells out Fed’s pullback strategy

WASHINGTON – A snowstorm Wednesday didn’t keep Federal Reserve Chairman Ben Bernanke from outlining how the central bank might pull back its unprecedented intervention in the U.S. economy. But how exactly the long-awaited exit strategy would be deployed was obscured in a blizzard of ambiguities.

“Although at present the U.S. economy continues to require the support of highly accommodative monetary policies, at some point the Federal Reserve will need to tighten financial conditions by raising short-term interest rates and reducing the quantity of bank reserves outstanding,” Bernanke wrote in prepared testimony for a hearing Wednesday by the House Financial Services Committee.

While the hearing was postponed, the Fed released Bernanke’s testimony anyway. He provided new details of how the Fed might scale back the steps it had taken to keep credit flowing in the wake of the financial crisis.

Although Bernanke talked about what the Fed could do, he said little about when.

Bernanke said one area the Fed was focusing on was the money banks were holding as reserves. At the height of the crisis in fall 2008, Congress gave the central bank the authority to pay interest on such funds as a way of stabilizing the banking system. By increasing the interest rate on those reserves, the Fed would push up all short-term interest rates from their historic lows.

Although that could increase borrowing costs, it would allow the Fed to tighten the money supply to prevent inflation.

The Fed also is intent on reducing the reserves held by banks, which would free up more money for lending. The Fed is looking at expanding so-called reverse repurchase agreements, which allow banks to drain some of their reserves, and allowing banks to convert reserves into something “roughly analogous to certificates of deposit” that could be used to meet short-term liquidity needs, Bernanke said.

Bernanke reiterated that the the interest rate likely would be kept low for “an extended period.”

But he said he was confident the Fed would be able to reduce the size of its balance sheet, which ballooned to $2.2 trillion as it took on riskier investments than the Treasury securities normally purchased.

“In the long run, the Federal Reserve anticipates that its balance sheet will shrink toward more historically normal levels and that most or all of its security holdings will be Treasury securities,” Bernanke said. He also predicted that the expanded Fed programs, including large-scale purchases of mortgage-backed securities from Fannie Mae and Freddie Mac, “are likely to generate significant positive returns for taxpayers.”