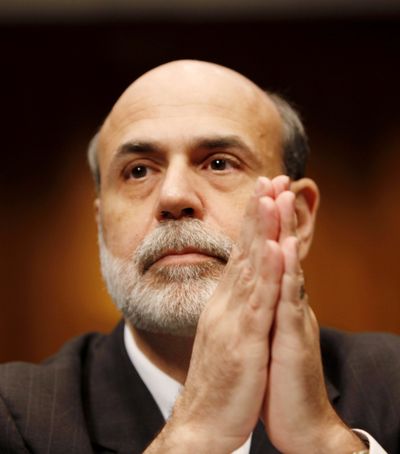

Fed chief backs power

He says regulation curbs speculation

WASHINGTON – Stronger regulation is the best way to prevent financial speculation from getting out of hand and throwing the economy into a new crisis, Federal Reserve Chairman Ben Bernanke said Sunday.

But he didn’t rule out higher interest rates to stop new speculative investment bubbles from forming.

The Fed chief’s remarks were his most extensive on the subject since the housing market’s tumble led to the gravest financial crisis since World War II – and perhaps the worst in modern history, in his view.

Critics blame the Fed for feeding that speculative boom in housing by holding interest rates too low for too long after the 2001 recession.

But Bernanke, in a speech to the American Economic Association’s annual meeting in Atlanta, defended the central bank’s actions. Extra-low rates were needed to get the economy and job creation back to full throttle after the Sept. 11 attacks and accounting scandals that rocked Wall Street, he said.

Still, the enormous economic damage from the housing bust – the longest and deepest recession since the 1930s and double-digit unemployment – shows how important it is to guard against a repeat, Bernanke said.

“All efforts should be made to strengthen our regulatory system to prevent a recurrence of the crisis, and to cushion the effects if another crisis occurs,” he said.

Speculative excesses are not easy to pinpoint in their early stages, he said, and using higher interest rates to combat them can hurt the economy.

For instance, rate increases in 2003 and 2004 to constrain the housing bubble could have “seriously weakened” the economy just when a recovery from the 2001 recession was starting, he said.

To help the country emerge from that recession, the Fed under then-Chairman Alan Greenspan cut its key bank lending rate from 6.5 percent in late 2000 to 1 percent in June 2003. It held rates at what was then a record low for a year. It’s this action that critics blame for feeding the housing speculation.

Bernanke, however, said the expansion of complex mortgage products and the belief that housing prices would keep rising were the keys to inflating the housing bubble. As a result, lenders made home loans to people to finance houses they couldn’t afford.

Still, Bernanke said the lesson learned from the crisis isn’t that regulation is ineffective but that regulation “must be better and smarter.”