Hart’s tax woes now approach $1 million

The Internal Revenue Service has filed another nearly $300,000 in tax liens against Idaho Rep. Phil Hart, R-Athol, bringing the total that public records show Hart owes in back taxes, interest and penalties to nearly a million dollars.

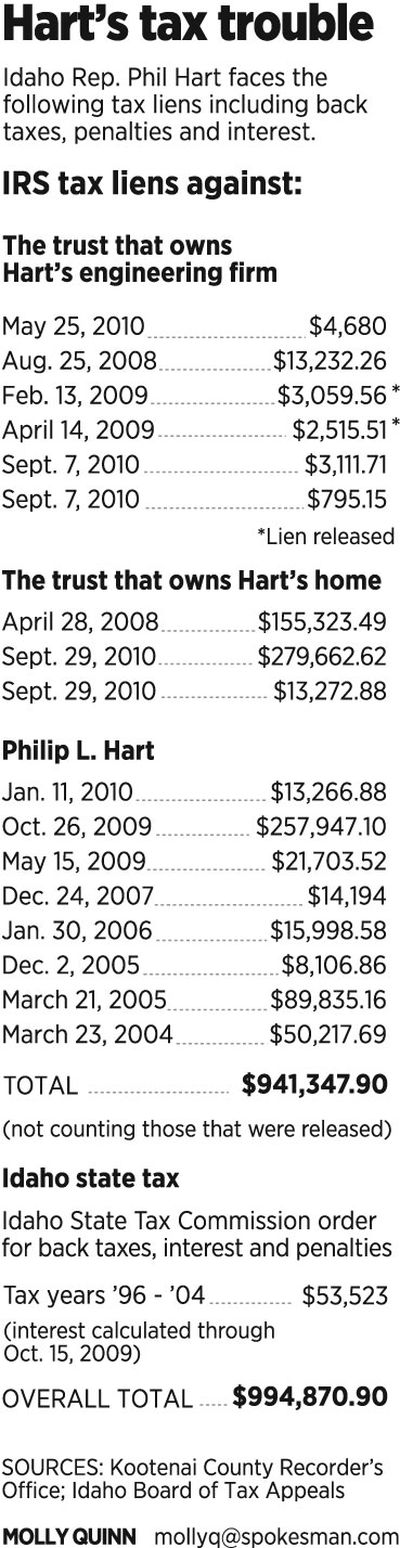

The IRS filed two liens for $292,935 against Hart on Wednesday in Kootenai County, both targeting Hart as a nominee for the trust that owns his Athol home. All are for individual income taxes, penalties and interest from the tax years 1997 through 2003, plus 2006 and 2008.

In addition, on Sept. 7, the federal tax agency filed another $3,906.86 in liens against the trust that owns Hart’s North Idaho engineering firm; those liens were for withholding taxes and corporate income taxes.

Hart said Friday that he was unaware of the additional liens until informed of them by a reporter. “I’m finding out about it for the first time,” he said. Asked why the IRS might be filing additional large liens against him now, Hart said, “Well, all I know is it’s the election season.”

In an earlier appeal filed with the state Board of Tax Appeals, Hart’s Coeur d’Alene attorney, Starr Kelso, wrote that Hart’s tax woes are “entirely the result of political persecution of Mr. Hart by the IRS.”

Hart said he figured the liens against the Sarah Elizabeth Hart Trust, which owns his home and bears his daughter’s name, must duplicate IRS liens the agency already has filed against him personally. There are now $471,269.79 in outstanding liens against Hart personally, and $448,258.99 against the Sarah Hart Trust.

But IRS spokeswoman Karen Connelly said the IRS typically won’t file duplicate liens for the same tax debt. “No, generally speaking, you add them together,” she said Friday. “Because otherwise, it’s sort of like double jeopardy. If it’s an individual plus a nominee on a trust, usually those two amounts would be for two separate tax issues.”

The new liens bring the total IRS liens outstanding against Hart to $941,347.90. When an outstanding Idaho State Tax Commission order for $53,523 in back state income taxes, penalties and interest is added to that, Hart owes $994,870.90.

“I don’t think that’s realistic,” Hart said Friday. He maintains the IRS is inflating the amount he owes because it disallowed eight years of his business exemptions in an audit. “When you compare my situation with the average person, those numbers are artificially high, because most other businesses buy a roll of stamps and they use those postage stamps in the business, they get to deduct them,” he said, “but I was not able to.”

He also said he’s paid more than $120,000 in state and federal taxes in the past five years, but said, “Not one dollar of that has offset any lien amount.” Hart said the IRS has credited his most recent payments to his 1995 taxes, and he maintains he doesn’t owe anything for that year, when he paid taxes but filed for a full refund that he says he didn’t receive.

Hart stopped filing federal and state income tax returns in 1996 while he pressed an unsuccessful lawsuit claiming the federal income tax is unconstitutional. He’s since conceded and made partial payment, but both the state and the IRS contend he still hasn’t paid in full.

Last week, a special House Ethics Committee voted unanimously to recommend that Hart be removed from the House Revenue and Taxation Committee while he presses his personal tax fight. Hart refused to resign from the panel; he’s maintained there’s no conflict between his tax battle and his role there. The committee is where all tax measures considered in the Idaho Legislature originate.

Hart was unopposed for a fourth term in the Idaho House of Representatives in November until a Hayden businessman, Howard Griffiths, filed against him as a write-in this summer, saying he was challenging the fellow Republican out of concern over Hart’s tax issues.