Hart owes less than tax liens suggest

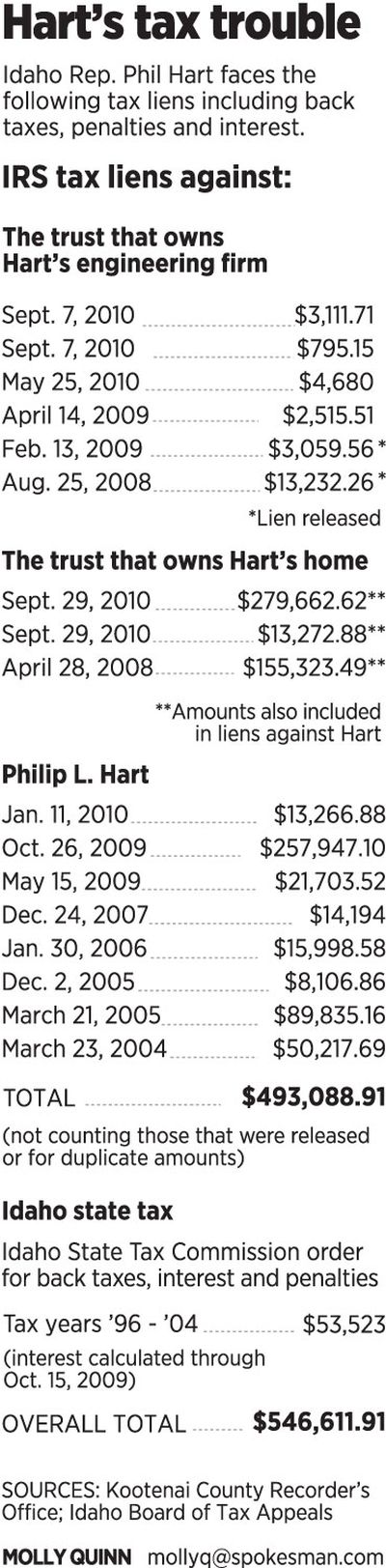

BOISE - Tax-protesting Idaho Rep. Phil Hart only owes half as much in back taxes, penalties and interest as tax liens against him suggest - just over half a million dollars, rather than nearly a million.

The Internal Revenue Service on Monday reversed itself and said the new liens it filed against Hart last week as a nominee of a trust could duplicate other liens it earlier filed against Hart personally. That’s the opposite of what the agency said on Friday, when IRS spokeswoman Karen Connelly said the IRS typically won’t file duplicate liens for the same tax debt.

On Monday, Connelly said she’d been mistaken. “Apparently nominee liens can and often do cover the same tax debt as individual liens,” she said.

It’s a nearly half-million-dollar difference when it comes to total tax debt for Hart, who maintains his decade-and-a-half fight with the IRS is the result of political persecution.

The IRS doesn’t comment on individual taxpayers’ cases, but Connelly said in an email that she wanted to “set the record straight” about her earlier comments on duplicate liens.

Hart said Friday that he suspected that duplication. The new liens filed last week against Hart as a nominee for the Sarah Elizabeth Hart Trust, the trust Hart set up in his daughter’s name and whose only asset is his Athol home, totaled $292,935.50, and came on top of $155,323.49 in liens the IRS filed against the house trust in April of 2008.

“The house is not an income-producing entity,” Hart said Friday. “So whatever the liens are on the house, it has to be a doubling up of what they say that I owe.”

A line-by-line comparison of liens the IRS has filed against Hart and those it’s filed against the house trust shows that virtually all of the liens against the house trust duplicate some, though not all, of the liens against Hart himself.

Oddly, the liens against the trust add up to $448,258.99 - far more than the assessed value of the home, which according to Kootenai County records is just $271,573. “It’s actually not that big,” Hart said of the house, which sits on 10 acres in rural Athol.

The IRS also has filed $471,269.79 in liens against Hart personally, plus $21,819.12 in liens against a trust Hart set up as owner of his Hayden engineering firm; those liens are for business taxes and do not duplicate the other liens, which are for individual income taxes.

Hart has been wrangling with the IRS and the Idaho State Tax Commission since he stopped filing federal and state income tax returns in 1996 while he pressed an unsuccessful lawsuit claiming the federal income tax is unconstitutional. He’s since conceded and made partial payment, but both the state and the IRS contend he still hasn’t paid in full.

Hart says he’s paid more than $120,000 in state and federal taxes in the past five years, and said his negotiations with the IRS are ongoing. He’s also attempting to appeal the state Tax Commission’s order that he pay $53,523 in back state income taxes, penalties and interest, though his appeal already has been rejected once.

The filing of the new liens against Hart last week - on top of two more IRS liens filed against his business earlier in September - show the federal tax agency still is going after Hart for the debt.

Connelly, in her email, said, “The IRS nominee lien secures the government’s interest in property that a taxpayer transfers to a nominee entity.” She said, “We file a ‘regular’ tax lien and also a nominee lien for the same tax years. In essence, it can be construed as a duplicate lien. We need it to ensure creditors understand the IRS has a lien interest in the property that is titled to a nominee.”

A special House Ethics Committee cleared Hart of two ethics charges related to his tax issues, but voted unanimously last month to recommend that he be removed from the House tax committee.

The committee declined, in split votes, to censure Hart for conflicts of interest on specific votes, or for repeatedly invoking the legislative privilege against arrest or civil process during sessions to win delays in his state and federal tax fights.