Fed likely to target inflation concerns

Panel likely to let stimulus program expire

WASHINGTON – The Federal Reserve is increasingly confident in the economy and about to end a $600 billion program to support it. Now for the next step – figuring out how to keep inflation from taking off.

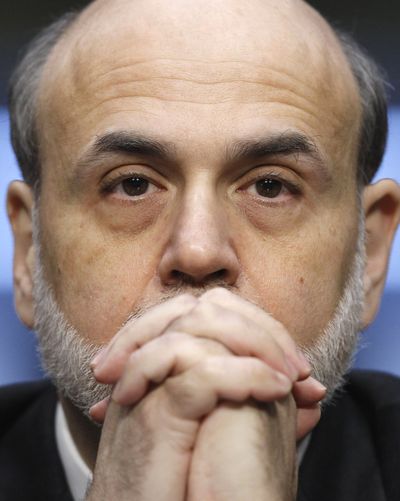

Since late last year, the Fed has bought government bonds to keep interest rates low. Fed Chairman Ben Bernanke and his colleagues are expected to signal this week that they will allow the program to expire in June. When meetings begin today, here are some of their options:

Fearful of runaway inflation

• RAISE RATES: The Fed could raise the rate it charges banks for emergency loans. That rate, called the discount rate, is 0.75 percent. An increase in the discount rate wouldn’t directly affect interest rates charged to consumers and businesses. But it would be viewed that rates will soon rise.

• TIGHTEN CREDIT: The Fed said last year that it will likely start to tighten credit by boosting the rate it pays banks on money they leave at the central bank. Doing so would raise rates tied to commercial banks’ prime rate and affect many consumer loans. The rate paid on banks’ excess reserves is 0.25 percent. Boosting that rate would give banks an incentive to keep money at the Fed rather than lend it.

Tightening credit by adjusting the rate it pays on banks’ excess reserves would be a new strategy for the Fed. Since the 1980s, its main lever to adjust credit has been the federal funds rate. That’s the rate banks charge each other for loans. It’s now at a record low near zero.

Setting interest rates through the excess reserves rate gives the Fed more control over money floating through the financial system. The Fed sets that rate directly. By contrast, its federal funds rate is merely a target.

For consumers and businesses, a shift in which tool the Fed uses to tighten credit would make little practical difference. A bump-up in either the rate on excess reserves or the federal funds rate would boost the prime lending rate, now at 3.25 percent, by the same amount.

• OTHER OPTIONS: Selling securities from the Fed’s portfolio, with an agreement to buy them back later. Those operations are called reverse repurchase agreements. Or the Fed could sell securities outright. Those moves would tighten credit by mopping up some of the money that was pumped into the economy during the financial crisis.

Fearful of a weakening economy

• MORE STIMULUS: Embark on a third round of stimulus, probably by buying more Treasury bonds. The goal would be to lower rates on loans and push up stock prices. That could spur spending and invigorate the economy.