QE2 likely helped economy

U.S. bond program’s boost may be temporary

WASHINGTON — It would drop interest rates and lift stock prices. It would ignite inflation. It was useless.

Opinions of the Federal Reserve’s program to buy $600 billion in Treasury bonds diverged sharply after the Fed unveiled it in November.

Now, as the Fed wraps up its latest policy meeting today, the bond purchases are about to expire. In the end, most experts suggest, they probably didn’t hurt and might have helped the economy, at least temporarily.

The bigger question, though, is: What happens now?

The program was dubbed QE2 – not for the Queen Elizabeth ocean liner but as shorthand for “quantitative easing.” That’s the wonky term economists use for a tool the Fed can use to drive down long-term interest rates. It does so by buying Treasury bonds.

QE2 marked the second round of such easing the Fed had taken; the first was in March 2009, at the depths of the recession.

Supporters say the bond purchases worked, in part by keeping rates low and encouraging spending. Low long-term rates are vital for consumers who are buying homes and cars and for companies that are making investments.

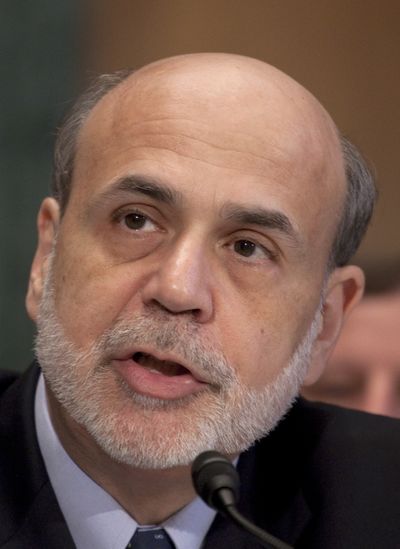

They also argue that those lower rates fueled a stock rally. When Fed Chairman Ben Bernanke outlined plans for QE2 in late August, the Standard & Poor’s 500 stock index had fallen 6 percent for the year. In the eight months that followed, the S&P 500 jumped 28 percent. Lower rates made stocks more attractive than bonds, whose yields were falling.

Much of the boost from QE2 came before the bond buys actually began. Bond investors drove down long-term rates in anticipation of the purchases.

From the time Bernanke revealed plans for QE2, for example, until the purchases began in November, the average rate on a 30-year fixed mortgage sank from 4.36 percent to 4.17 percent. That was a 40-year low.

Mark Zandi, chief economist at Moody’s Analytics, said the bond purchases gave a sagging economy a lift by slightly reducing borrowing costs for businesses and consumers and by raising stock prices to make people feel wealthier. Still, it didn’t much energize home buying or other major purchases.

“It wasn’t a slam-dunk success, but it was worthwhile,” Zandi said.

Critics, including some Fed officials, saw things differently. They warned that by pumping so much money into the economy, the Fed increased the risks of high inflation later.

They complained that the Fed’s outpouring of dollars lowered the currency’s value and contributed to a spike in oil and food prices. They also said they feared the bond purchases fed speculative buying that could inflate bubbles in prices of stocks or other assets.

Some of the harshest criticism came from abroad. Officials in China, Brazil and Russia argued that by devaluing the dollar, the Fed’s efforts gave U.S. exports an unfair advantage. A lower dollar makes U.S. goods cheaper overseas and foreign goods more expensive in the United States.

Brazilian Finance Minister Guido Mantega warned last fall that the Fed’s efforts could spur a global currency war. In April, Russian Prime Minister Vladimir Putin denounced monetary “hooliganism.”

“They turn on the printing press and flood the entire dollar zone – in other words, the whole world – with government bonds,” Putin said.

In a speech this month, Bernanke hit back at critics. He argued that higher oil prices were due to Middle East turmoil and demand in fast-growing countries like China. He said food-price inflation was due mainly to shortages caused by bad weather. And he said the falling dollar was caused mainly by slower U.S. growth and the U.S. trade deficit.

Many critics have raised a more fundamental complaint: that the program didn’t achieve its goal of increasing growth.

The economy grew only weakly in the first three months of the year, thanks to high gasoline prices, government budget cuts and sluggish consumer spending. And it may be growing only slightly better in the current quarter. Consumers remain squeezed by gas prices, scant pay increases and a depressed housing market.

“There were some positive effects to the bond buying, but they were fairly transitory,” said David Wyss, former chief economist at S&P and now a visiting fellow at Brown University.

Still, Zandi said critics should recall that a year ago, the economy faced the threat of deflation – a destabilizing period of falling prices. He said the bond buying helped banish that threat while strengthening the economy slightly.

The purchases are set to expire June 30. Most economists say they don’t think loan rates will rise. They note that the Fed is hardly ending all its Treasury purchases. It will remain the biggest market buyer, by reinvesting in Treasurys as its existing holdings come due. Those purchases should help keep long-term rates low.

Many analysts say they think the Fed won’t start reducing its Treasury stockpile until next year. And they don’t expect it to increase short-term rates until a year from now. The Fed’s key rate, the federal funds rate, has been at a record low near zero since December 2008.

One thing economists don’t expect: a QE3. Bernanke and other Fed officials have signaled there are no plans to invest new money in Treasurys.