Critics contend Cain’s 9-9-9 plan will hurt the poor

WASHINGTON – Republican presidential candidate Herman Cain’s proposed 9-9-9 tax plan would shift the tax burden in the United States, raising taxes on the poor while cutting taxes for the wealthy.

Cain proposes to scrap the current tax code and replace it with a flat 9 percent tax on personal income, a second 9 percent tax on corporate income and a third 9 percent tax on sales. It also would eliminate the payroll tax, which funds Medicare and Social Security; the estate tax; and capital gains taxes.

While the Cain campaign has not produced enough details for thorough independent analysis, a flat 9 percent income tax and a 9 percent national sales tax would almost certainly mean higher taxes for at least the 30 million U.S. households that now pay no federal taxes.

And it almost certainly would mean big tax cuts for the wealthy, who now pay a 35 percent marginal rate on their income above $379,150.

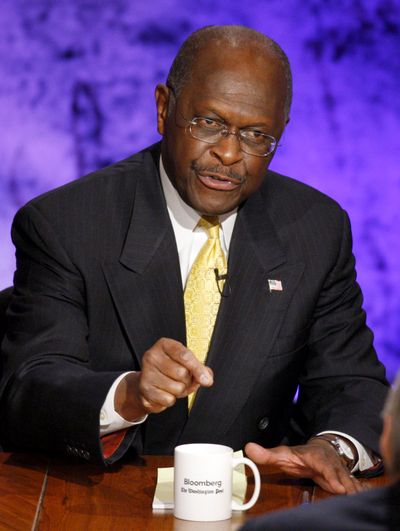

The catchy 9-9-9 tax plan has helped the former Godfathers Pizza CEO surge into the top tier contending for the 2012 Republican presidential nomination. With his rising support, Cain’s plan is drawing more scrutiny, with the potential shift of the tax burden just one of the profound effects the dramatic change in tax policy could have – if Cain were elected and managed somehow to get it past an army of lobbyists and through Congress to enactment.

Ultimately, in a second phase, Cain’s plan would eliminate all income taxes for individuals and for corporations in favor of a national sales tax. To raise sufficient money to fund the government, the sales tax rate would rise significantly, perhaps to 23 percent, analysts estimate, though Cain hasn’t specified a level yet.

The changes in income taxes would turn away from the progressive tax policy that’s shaped U.S. policy for a century, based on the principle that the wealthier people are, the more they can afford to pay in taxes to the society that’s enriched them.

“The plan could be expected to raise substantial amounts of revenue, but does so largely by skewing downward the distribution of tax burdens,” said a new analysis of the Cain plan this week by Edward D. Kleinbard, a professor of tax law at the University of Southern California. He’s also a former chief of staff at the congressional Joint Committee on Taxation, which analyzes all tax legislation for Congress. “The 9-9-9 Plan would materially raise the tax burden on many low- and middle-income taxpayers.”

Others agree.

“It’s regressive, relative to what we have now,” said Roberton Williams, a senior fellow at the Tax Policy Center, a joint effort of the Urban Institute and Brookings Institution, center-left policy-research centers. “It would raise taxes for people at the bottom and lower taxes at the top end.”

Cain has insisted it would not hurt poorer Americans, in large part because he would eliminate the payroll tax. But nearly 30 million households – about 18 percent – pay neither income taxes nor the FICA payroll tax, according to Williams. Most would pay more, perhaps much more.

Cain proposes to levy the 9 percent flat tax on all income after allowing an undetermined amount of charitable contributions to be deducted. He also would create “empowerment zones” where people would have additional deductions.

People with lower incomes also would pay a disproportionate share of their income in sales taxes, because they spend much more of their income on retail goods.

Wealthier Americans could pay lower taxes. First, there would be no taxes on capital gains or large estates. Second, all income after deductions would be taxed at 9 percent. As of now, taxable income over $379,150 is taxed at 35 percent.

“If you’re one of the minority of people, the top 10 percent of the population, who pay 70 percent of the income tax revenues, you might see the change as a good deal,” said Dean Clancy, legislative counsel for FreedomWorks, a conservative group.

“But if you’re lower down the income scale, and especially if you’re one of the 50 percent of Americans who don’t pay any income taxes, then you might not see it as such a good trade. And if you’re poor, you might really hate it.”

A lot depends on details that Cain has not yet released. For example, it’s unknown if he would make people pay the sales tax on food and medicine. If he exempted those, as many states do, more people would pay lower taxes.

But the government also would collect fewer revenues to pay its bills – or it would have to raise the sales tax rate.

Cain said in a debate Tuesday that his plan would leave government revenues essentially the same, basing his conclusion on advice from “well-recognized economists” and a study by an “independent” firm. He did not identify either the economists or the firm, and did not release the study. The one economic adviser he did name was Rich Lowrie, a manager for Wells Fargo who is not a trained economist.

Moreover, he said he relied on “dynamic” scoring, the theory that revenue estimates of what changes to taxes would yield should be based not just on the taxes themselves, but on presumed growth in the economy after taxes fall.

One media analysis by the Bloomberg news service said the plan as proposed would leave the government with about $200 billion less in revenues than it’s collecting now.

Cain’s talk of his 9-9-9 plan also does not address his ultimate goal, the abolition of income taxes and the Internal Revenue Service in favor of a national sales tax alone, or Fair Tax.

While that would replace two of the nines with zeros, it also would necessarily multiply the third. One recent Fair Tax proposal hinged on a 23 percent national sales tax as necessary to match today’s revenues.