Study counters Cain’s tax claims

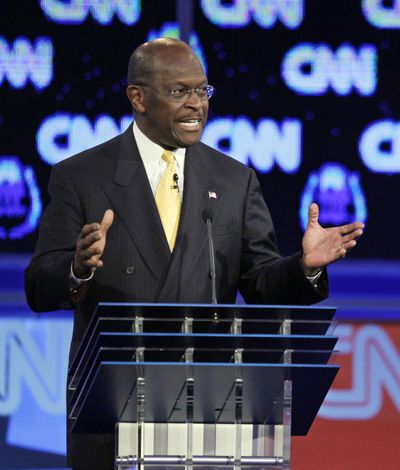

Herman Cain’s 9-9-9 tax plan would raise taxes on 84 percent of U.S. households, according to an independent analysis released Tuesday, contradicting claims by the Republican presidential candidate that most Americans would see a tax cut.

The Tax Policy Center, a Washington think tank, says low- and middle-income families would be hit hardest, with households making between $10,000 and $20,000 seeing their taxes increase by nearly 950 percent.

“You’re talking a $2,700 tax increase for people with incomes between $10,000 and $20,000,” said Roberton Williams, a senior fellow at the Tax Policy Center. “That’s huge.”

Households with the highest incomes, however, would get big tax cuts. Those making more than $1 million a year would see their taxes cut nearly in half, on average, according to the analysis.

Among those in the middle, households making between $40,000 and $50,000 would see their taxes increase by an average of $4,400, the report said. Those making between $50,000 and $75,000 would see their annual tax bill go up by an average of $4,326.

Cain disputed the analysis Tuesday evening during GOP presidential debate in Las Vegas, where the other Republican candidates heaped on criticism. Cain has acknowledged that taxes would increase for some but says taxes would decrease for most.

Cain’s plan would scrap current taxes on income, payroll, capital gains and corporate profits. He would replace them with a 9 percent tax on income, a 9 percent business tax and a 9 percent national sales tax.

Associated Press