Motley Fool: Clorox stock shows potential to clean up

If you’re looking for a blue-chip dividend-paying stock, consider Clorox (NYSE: CLX), recently yielding 3.5 percent. With brands such as Pine-Sol, S.O.S., Tilex, Green Works, Fresh Step, Scoop Away, Glad, Brita, Hidden Valley, Burt’s Bees, Kingsford and Liquid-Plumr, it’s readying to celebrate its 100th year, and its prospects for growth are looking as fresh as ever.

The company, which has four operating segments – cleaning, household, lifestyle and international – fills the bill as a Peter Lynch “buy what you know” candidate because it has easily recognizable products and an easy-to-understand business model. It can provide downside protection for your portfolio because of the inelastic prices on many of its products. These products are necessary, too. No matter what the economy is doing, you’ll probably still apply lip balm, clean your kitchen, change your cat’s litter, unclog drains and occasionally grill some food.

Its mixture of well-known brands, an easily understood business model and strong pricing power continues to drive Clorox’s innovation and growth. The company’s sales volume has been growing, too, as has its dividend, which has been raised for 35 straight years.

Clorox is likely to be a successful company for another 100 years. Its stock is not quite a bargain now, so keep an eye on it.

Ask the Fool

Q: On my next tax return, can I deduct from my income a big loss I incurred this year from a stock sale? – S.W., Dothan, Ala.

A: If you have any capital gains from stock sales, you’ll first offset them with your loss. Any loss beyond that, or all of your loss if you have no capital gains, can be deducted from your income – up to $3,000 per year. Sums above $3,000 can be carried over to the following year.

If you’re in the 25 percent tax bracket and you deduct $3,000 from your income, you’re excluding that amount from taxation. So you save 25 percent of $3,000, or $750. Of course, you’ve still lost money. You just decreased your loss.

My dumbest investment

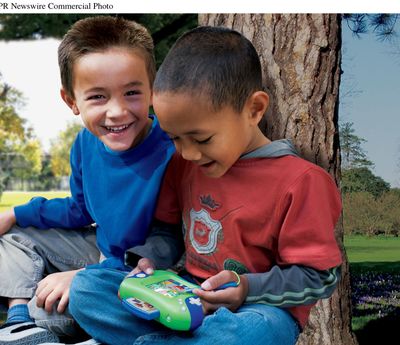

One of my earliest losers was LeapFrog Enterprises, with its electronic learning tablet. I figured that parents love their kids and will shower them with the best educational toys. Lesson learned: As with kiddie clothes, most parents are not that fussy about brands of toys. And with technology-based toys such as the LeapPad, there wasn’t much sustainable competitive advantage.

Fisher-Price soon came out with a rival product and LeapFrog had to discount heavily. The results were predictable: Profit margins fell and earnings shrank. Lesson No. 2: Rave reviews are not enough. – F.E., Singapore

The Fool responds: LeapFrog was first to market with its electronic learning device, but that rarely guarantees success. Deep-pocketed competitors could – and did – come up with similar products.

Bigger companies also tend to enjoy advantages such as economies of scale and large, established distribution channels. It’s great to find a company with a new and compelling product, but you need to be confident in its ability to compete well. LeapFrog has survived and is growing, but its stock, recently around $11 per share, is well below its 2003 high near $40.