Lavish Lake Coeur d’Alene home at center of foreclosure dispute

After a successful career developing retirement communities, Denny Ryerson planned to kick back and enjoy his own retirement on a sandy shore of Lake Coeur d’Alene.

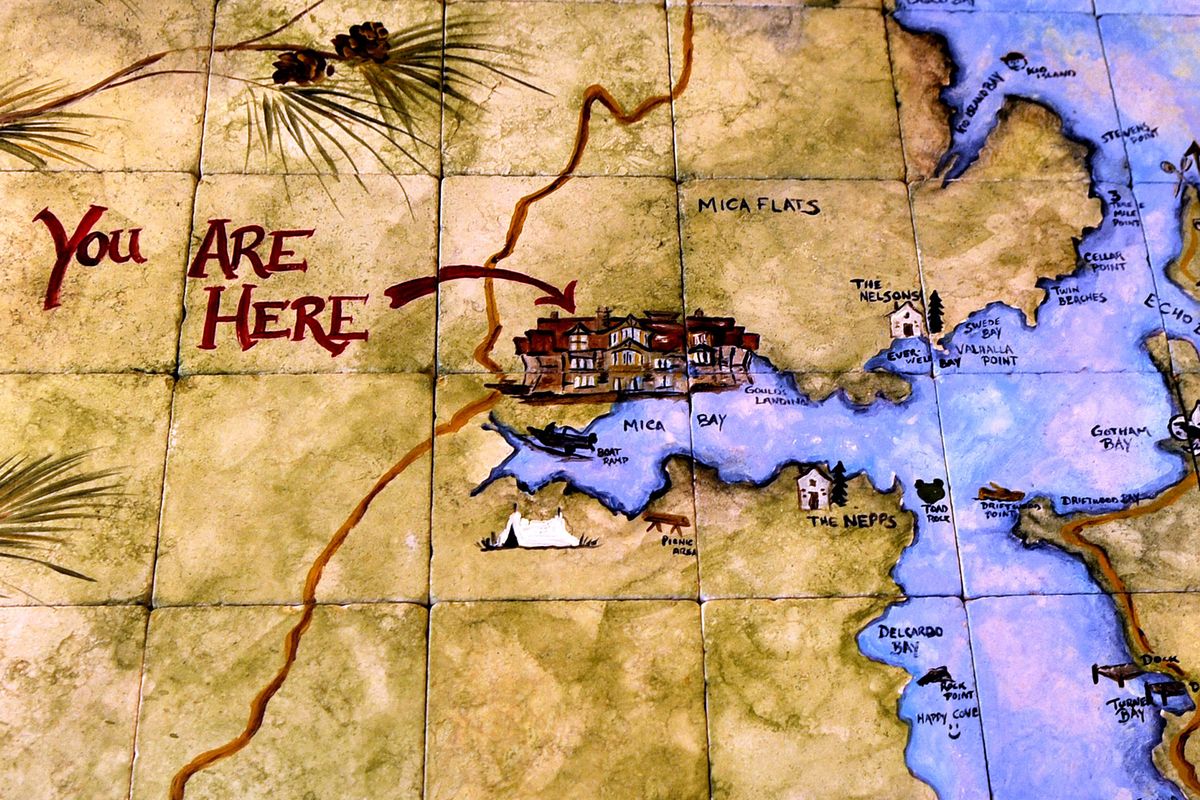

He built his dream home on 2.2 acres on Mica Bay, a spread that includes an 11,000-square-foot main house, a caretaker’s house and a guest house above the garage. The main house has four bedrooms, each with its own laundry facilities, plus seven full- and half-baths, a rosewood office and a kitchen with both a wood-burning brick pizza oven and separate $45,000 gas range. Ryerson and his wife have hosted up to 250 people there.

And then the economy crashed and Ryerson, like hundreds of thousands of others, crashed hard along with it.

The Arizona developer filed for Chapter 11 bankruptcy protection last fall, listing debts of more than $14 million.

Now one of Coeur d’Alene’s most expensive waterfront homes is at the center of a legal battle involving Ryerson; his former lender, Idaho Independent Bank; and a company that bought the notes on the home from that bank.

Ryerson, 68, a member of Gonzaga University’s board of regents, is trying to sell the home for what he believes is its full value. It was listed in 2012 for $10.5 million – or $12.5 million including all its furnishings and art. The listing made it onto the Wall Street Journal’s website as the house of the day.

A bankruptcy court judge ruled in late February that the home’s value for the purpose of the bankruptcy filing should be $9 million.

Ryerson has argued that he should have until later this spring to find a buyer, noting that area property brokers are seeing a resurgence of interest in high-end lake homes.

Greg Rowley, a real estate agent representing Ryerson’s home, said the waterfront lot’s soft, sandy beach is rare on Lake Coeur d’Alene.

“Homes with a natural beach like that are very coveted,” Rowley said.

But Bankruptcy Court Judge Terry Myers denied that request, saying a foreclosure can go ahead this spring.

That could mean another businessman, Dana Martin, of California, could end up with the home after paying just $6.1 million.

Martin formed a company called Anaconda LLC in August 2013 and bought the notes for Ryerson’s loans from Idaho Independent Bank for that amount. The bank’s three loans to Ryerson totaled $8.8 million.

In court documents, Spokane attorney John Munding — also the court-appointed bankruptcy trustee — said: “As Martin’s testimony makes clear, the purpose of forming Anaconda was to foreclose on Ryerson’s defaulted debt obligation and to obtain possession of the Ryerson home and two adjacent lots without paying fair market value.”

Those documents hint of a possible civil suit by Ryerson if Martin’s Anaconda LLC ends up with the home, with a potential claim that the company obtained the notes through wrongful disclosure of private financial information.

An attorney representing Anaconda declined comment.

John Kurtz and Sheila Schwager, attorneys for Idaho Independent Bank, emailed a statement reading: “Idaho Independent Bank did not violate Ryerson’s financial privacy or otherwise engage in any action that would support a claim by Mr. Ryerson.”

Munding said it’s still Ryerson’s hope to sell the property before it can be foreclosed.