401(k) accounts defied 2000-02 bear market

NEW YORK – Most Americans who invest in 401(k) retirement savings accounts weathered the 2000-2002 bear market downturn pretty well, according to a research report issued Monday.

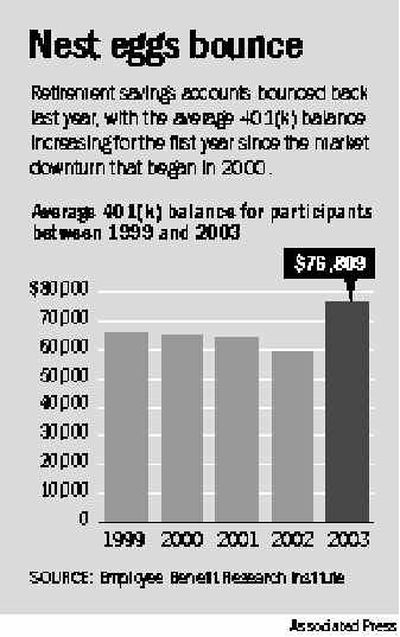

The average account balance at the end of 2003 was $76,809, up nearly 30 percent from $59,510 a year earlier thanks to the stock market recovery, the study found. And it was also up more than 17 percent from the average $65,572 in accounts at the end of 1999, before the market downturn, it said.

“401(k) participants were undeterred by the bear market,” said Sarah Holden, a senior economist with the Investment Company Institute in Washington, D.C., who was co-author of the report.

The study was prepared by the ICI, a mutual fund trade group, and the Employee Benefit Research Institute, a nonprofit research organization that is also based in Washington.

The 401(k) accounts take their name from a section of the tax code. Some 42 million workers have 401(k)s, with assets totaling some $1.9 trillion.

The report said that balances held up in 401(k) accounts despite the bear market because savers held to the basic tenets of long-term investing.

“For many participants, diversification of assets and ongoing contributions helped to temper the impact of the equity markets on their 401(k) balances, the report said.

Still, not everyone came through unscathed.

Account balances for savers in their 60s were down over the five-year study period, as were the balances of some in their 50s. The balances of savers in their 60s dropped to an average of $127,130 at the end of 2003 from $139,317 five years earlier, the study found. Some long-time savers in their 50s saw account balances drop to $146,509 at the end of last year from $161,537 five years earlier, it said.

Holden said that could reflect withdrawals by workers moving into retirement and the fact that annual contributions by older workers may not have been big enough to compensate for the beating equities took from 2000 to 2002.

The study also showed that Americans have become more wary of equities and of holding too much stock in the companies they work for.

The percentage of stock funds in 401(k) accounts rose to a high of 53 percent in 1999 and dropped to a low of 40 percent in 2002 before recovering to about 45 percent in 2003, the report said.

It remains unclear, however, whether savers intentionally lowered their exposure to stocks — and increased their holdings of bond funds, balanced funds and other investments — or their equity holdings were reduced by the market.

“Investment performance likely explains the bulk of the changes in 401(k) plan participants’ asset allocations over time,” the report said.

At the end of 2003, savers had about 45 percent of their assets in equity funds, 9 percent in balanced funds, 16 percent in company stock, 10 percent in bond funds, 5 percent in money funds and 13 percent in other instruments, such as stable-value funds or guaranteed investment contracts.

Temple University professor Jack VanDerhei, who wrote the report with Holden, noted that many workers in their 20s and 30s have no equity holdings in their retirement accounts. According to the study, 38 percent of savers in their 20s and nearly 28 percent of savers in their 30s have no equity holdings in their 401(k) accounts.

Because stocks have traditionally earned more than bonds and other investments, he worried that these savers won’t earn the returns they need to accumulate adequate retirement balances.

Savers on average had 16 percent of their assets in company stock at the end of 2003, down from a high of 19 percent five years ago. Still, nearly 13 percent of savers still had 80 percent or more of their assets in company stock, he said.

The report also indicated that nearly one in five savers had loans outstanding from their 401(k) accounts at the end of last year. The average balance was $6,839, it said.