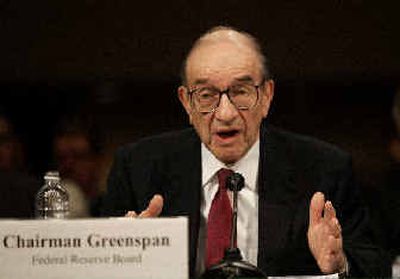

Greenspan sees positives in economy

WASHINGTON — The economic expansion has firmed, yet inflation remains tame, Federal Reserve Alan Greenspan said Wednesday. That buttressed economists’ view that the Fed for now will stick with its gradual approach to raising interest rates.

The Fed chief’s largely positive assessment of the country’s economic health came as he delivered the Federal Reserve’s twice a year economic outlook to the Senate Banking Committee.

Greenspan said the economy, which had been stuck in a midyear lull last year, has since improved, a welcome development since he presented the Fed’s previous economic report to Congress seven months ago.

“The evidence broadly supports the view that economic fundamentals have steadied,” Greenspan said. “All told, the economy seems to have entered 2005 expanding at a reasonably good pace, with inflation and inflation expectations well-anchored.”

Consumer spending, the economy’s lifeblood, remains healthy, he said. Business investment has picked up, although companies are still showing some caution in hiring, he added.

How inflation fares in the coming months will shape whether Fed policy-makers — now on a gradual path of raising short-term interest — will need to speed up or slow down that campaign, Greenspan indicated.

One factor to keep an eye on is whether companies — amid slowing productivity growth — boost workers’ salaries and then pass along those higher costs onto customers, the Fed chief said. The inflation outlook also will be shaped by the direction of oil prices and the value of the dollar, which has been falling over the last few years.

Fed policy-makers embarked on a rate-raising campaign in June and have pushed up short-term interest rates six times, each in modest, quarter-point moves. The last rate increase on Feb. 2 left a key rate at 2.50 percent. Another, quarter-point rate boost is expected at the Fed’s next meeting on March 22.

Even with increases thus far, rates are still “fairly low,” Greenspan said.

Economists viewed Greenspan’s remarks as reinforcing their view the Fed for now will stick to its gradual approach to raising rates. “In my view the bottom line is that we are in for more of the same,” said Steve Stanley, chief economist at RBS Greenwich Capital.

Keeping the Fed’s options open, Greenspan didn’t offer signals one way or the other.

Before the Fed started to push up rates in June, its key rate was at a 46-year low of 1 percent.