Homeowners seek tax relief

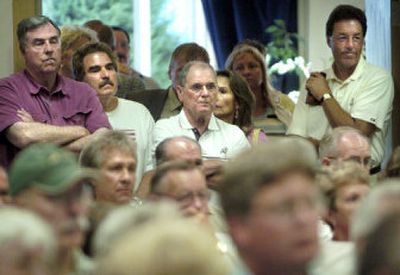

The message was consistent Wednesday across North Idaho as residents gathered to talk to state lawmakers about property taxes: “Stop taxing us out of our homes.”

Members of the joint legislative committee looking into property tax relief listened to stories of property values increasing as much as 243 percent in one year, emotional pleas to stop burdening the poor and threats of initiatives as its road tour stopped in Sandpoint and Coeur d’Alene. The committee will have hearings in Moscow and Lewiston today.

“I feel our elected officials are kind of afraid of a tax revolt,” Don Kisamore of Sandpoint told the committee. “All I can say is, ‘Bring it on.’ ”

With homeowners picking up an increasing share of Idaho’s property tax burden, and property values soaring in fast-growing areas like Bonner and Kootenai counties, concerns are running high. Emotions ruled often during the two hearings, causing bursts of clapping and an occasional boo.

Many people were upset that the Idaho Legislature has repeatedly refused to fix the tax system, and were skeptical about this series of special legislative hearings.

Former Bonner County Commissioner Tom Suttmeier told the committee he plans to file a petition Friday with the Idaho Secretary of State’s Office to start the process of introducing an initiative to cap both taxes and assessed values for all property. He would have to collect more than 44,000 signatures to get such a proposal on the ballot.

“In a perfect world you would do this job,” Suttmeier said.

In Coeur d’Alene, the Kootenai County Property Tax Relief Taskforce presented its own proposal to help reduce the tax burden on homeowners. The taskforce, created by Post Falls Republican Reps. Frank Henderson and Bob Nonini, wants to act as a resource for the legislative interim committee.

The taskforce proposes raising the amount of income allowed to qualify for the state’s circuit breaker program to $25,000 per year. Currently people older than age 65 can earn up to $22,040 and still quality for the subsidy that can mean a tax break ranging from $150 to $1,200.

The taskforce also suggests increasing the “50-50” homeowner’s exemption for people over the age of 65 who don’t qualify for the circuit breaker. Stemming from a 1982 voter-approved initiative, it exempts from taxation half the value of an owner-occupied home, not counting the land, up to a maximum of $50,000. The taskforce’s proposal would boost that maximum up to $70,000.

Several people at the two hearings recommend increases to the “50-50” homeowners exemption but didn’t wanted it limited to the elderly. Ed Lindahl of Sandpoint said it should be increased to $150,000 and then adjusted annually to fix what he called an “intolerable situation.”

Not everybody liked that idea. The proposed initiative would eliminate major exemptions, including the “50-50” homeowner’s exemption, along with all taxes on personal property, which mainly is charged on industrial equipment.

“Boos” erupted from the audience when Gilbert Beyer of Sandpoint said the initiative, which is modeled after California’s Proposition 13, isn’t viable and that California’s version degraded schools.

Sen. Shawn Keough, R-Sandpoint and the committee’s co-chairman, whipped off her shoe and pounded it on the table – using the navy pump as a gavel – demanding respect from the audience gathered at the Sandpoint High School auditorium.

“You can take me outside and hang me later,” Keogh said.

Don Billmire told the more than 400 people crammed into the Coeur d’Alene Inn that even if property tax is reduced, local governments will have to make up the money.

“Nothing you do is going to be fair to everyone,” he said. “You either shift it from one person to another or from one taxing authority to another.”

The Kootenai County taskforce suggested making it easier and less expensive for cities and counties to charge impact fees to help cover the costs of development. Developers could be charged for capital costs for police and fire protection, and new streets, parks and schools – costs now borne by landowners.

Some residents said Idaho needs to expand the local-option sales tax to help counties pay for big-ticket items other than jails. Kootenai County charges a half-cent extra in sales tax, to help pay for a $12 million jail expansion.

North Idaho lawmakers have failed to get the law changed so the tax can go to pay for things other than jails.

Keough promised that the committee will take citizens’ comments seriously, and recommend bills for the 2006 legislative session.

“This isn’t the end of it,” she said.