Bill introduced to renew cigarette tax increase for two more years

BOISE – Legislation to keep Idaho’s cigarette tax at 57 cents a pack for two more years – rather than drop it back down to 28 cents – finally was introduced in the House on Wednesday, but only after Idaho tribes blocked a last-minute addition to the bill.

House Speaker Bruce Newcomb said, “We were trying to go after the contraband,” including Internet sales of cigarettes. “But the tribes got nervous about what our intent was, so we decided not to.”

Newcomb said original drafts of the bill may have unintentionally implicated the tribes. But, he said, “We had no intention of taxing the tribes at all.”

In 2003, attempts by some House members to impose Idaho’s cigarette tax on Indian reservations failed four times on the House floor, including several last-minute bids in the final days of the session.

This is the first time the issue has surfaced this year – just days from the end of the legislative session.

“They just don’t want to give up,” said Bill Roden, lobbyist for the Coeur d’Alene Tribe. “It had a lot of things in it that directly affected the tribes. It was some of the things we’ve seen in previous sessions.”

The Idaho State Tax Commission has said a tax on tribal sales likely would be impossible to enforce due to jurisdictional, treaty and constitutional issues.

Roden and other tribal lobbyists met with the House leadership Wednesday, and the measure was scrapped in favor of a simple extension of the cigarette tax rate.

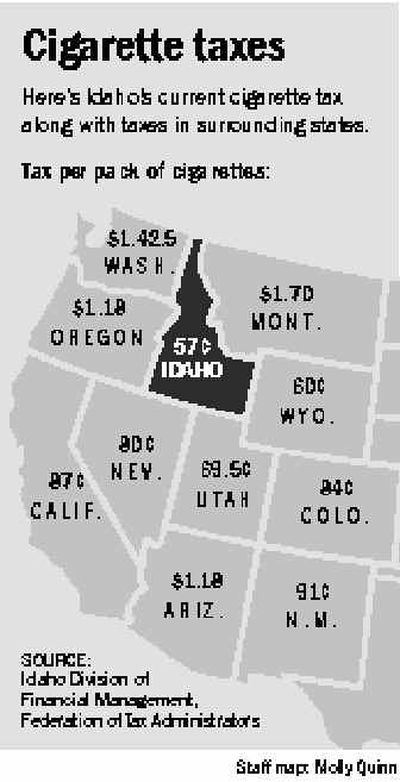

Some retailers objected when Idaho raised the cigarette tax two years ago, saying they would lose sales both to reservations and to other states where the tax was lower, as well as to Internet sales. Since then, however, all of Idaho’s surrounding states have raised their cigarette taxes to the point that Idaho’s is now the lowest. Tribes also have raised their cigarette taxes, though they vary.

Gov. Dirk Kempthorne originally proposed that the cigarette tax increase be permanent, but lawmakers made it a two-year increase, to match the two-year general sales tax increase they approved at the same time. Idaho’s sales tax is scheduled to drop back down from 6 percent to 5 percent on July 1.

Though there’s been generally wide agreement among lawmakers that the cigarette tax hike should be permanent, House Tax Chairman Dolores Crow, R-Nampa, opposed that. “A promise is a promise,” she said, vowing not to hear the bill in her committee, where all tax bills normally start.

Because of her staunch opposition, the bill was introduced Wednesday in the leadership-dominated House Ways and Means Committee. It would raise about $25 million a year.

The money may go to cover “bridge loans” for a southern Idaho water settlement, and possibly also to fund North Idaho water projects championed by Senate Finance Vice Chairman Shawn Keough, R-Sandpoint.

According to the American Heart Association, Idaho’s cigarette sales have dropped 12 percent since the tax was raised, because higher prices cause fewer people to smoke.