Ski resorts a flurry of development

COPPER MOUNTAIN, Colo. — A covered wooden bridge spans a sparkling creek spilling past the condominiums, T-shirt shops and restaurants that form the nucleus of this small community at the base of towering ski slopes.

Bill and Nellie Dry of Oklahoma City sat in the shade of an umbrella on a lazy summer day, watching visitors wander from shop to shop as rock music blared from a huge tented stage at the center of the pedestrian village.

“When we first started coming, we hiked a lot,” said Nellie Dry, who has visited this mountain resort with her husband for 17 years. “Lately, we’ve been laying back and enjoying the peace and quiet.”

With its ski runs blanketed in grass and wildflowers, Copper Mountain has built a blossoming summer business, a strategy mirrored from California to Vermont as resort owners expand their livelihoods beyond the snow by investing in condos, entertainment and, in at least one case, an adventure travel company.

“If you look at the larger companies in the industry, it’s a year-round business,” said Michael Berry, president of the National Ski Areas Association. “It’s really a hospitality industry on a year-round basis and we’re in the ski business from December to March.”

A half-century ago, it was fairly simple to get into the ski business: Put up a rope tow and wait for the snow to fall. With the advancement of snowmaking and high-speed lifts came the need for investment money that was more than lift ticket sales could generate.

At the same time, the pool of skiers and snowboarders has climbed just slightly in the past decade and largely consists of baby boomers who typically want more off-mountain entertainment.

Resort owners took over the ski schools, rental shops and on-mountain restaurants. They began investing in real estate development around the mountain base for lodging, restaurants, retail shops, grocery stores, service stations and entertainment such as music festivals to draw and keep visitors for longer periods of time.

Although ski areas survive without ancillary development, the business model today is to be a “comprehensive provider of everything,” Berry said.

“The base village concept promotes the idea of warm pillows and the greater the number of warm pillows, the greater number of lift tickets sold,” Berry said.

Berry pointed to Jiminy Peak in Hancock, Mass., a ski area that increased its bed base significantly over the last 10 years and saw a corresponding increase in lift ticket sales.

Some resort-area residents and leaders question the developments, hoping that they don’t permanently alter the small-town atmosphere.

Summit County commissioners this year rejected Intrawest Corp.’s planned development for Copper Mountain, concerned about adequate parking and the density of the condominium units. Intrawest is reshaping the plan to resubmit later this year.

“I don’t know if that would be good or not,” Jacinda Emmett of Greeley, Colo., said of the Intrawest project as she walked through Copper Mountain, 70 miles west of Denver. “It’s quiet.”

Vancouver-based Intrawest has developed an expertise in “building villages out of nothing,” said industry analyst Dennis McAlpine of McAlpine Associates LLC.

“The villages act as a magnet to get people there for vacations, for skiing, whatever,” he said. “And I think that’s obviously been the case at Vail and to lesser degrees at Keystone and Beaver Creek. Sure there’s risk with it, but that’s how they get the leverage on what they’re doing.”

Vail Resorts has become a major investor in real estate operations such as a $250 million project to renovate a portion of Vail called Lionshead Village. At Heavenly ski resort, which straddles the California-Nevada border, Vail Resorts has teamed with Marriott International Inc. to build time-share units and retail along the south shore of Lake Tahoe.

Vail Chief Executive Officer Adam Aron has said the developments target the baby boomer demographic, people between 50 years and 64 years old who are most likely to buy vacation real estate. In the first nine months of its fiscal year, Vail Resorts’ revenue from on-mountain activities rose 8.2 percent to $505.5 million, lodging revenue rose 8.4 percent to $145.1 million, while real estate revenue was nearly up 1.8 percent to $39.3 million.

“People tend to stay longer when there are more things to do and tend to spend more money,” said Intrawest spokesman Tim McNulty.

Intrawest, founded in 1976 as a real estate company, also has in the works multimillion-dollar developments at Tremblant north of Montreal and Stratton Mountain in Vermont. It also has joined with Aspen Skiing Co. to build $400 million base village at Snowmass Village.

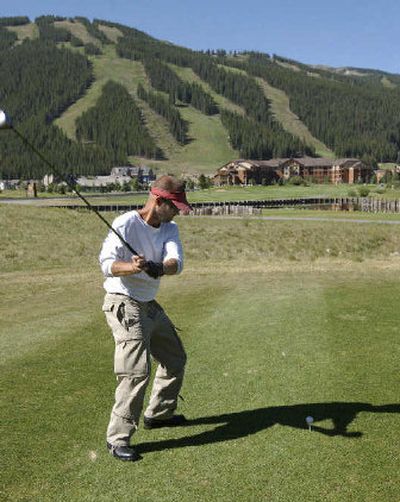

Off the mountains, Intrawest has golf courses, warm-weather resorts, a heli-skiing company and a majority interest in adventure tour operator Abercrombie & Kent.

Elsewhere, Summit Ventures Era is constructing a hotel, community building and condominium development at its Sugarbush Ski Resort near Warren, Vt., the first project to be built at the area in 20 years.

It comes as the number of available beds has declined in the past 15 years, which contributed to a drop in skier visits — an industry measure that represents a person participating in the sport of skiing or snowboarding for any part of one day, Sugarbush spokesman JJ Toland said.

“We get over 300,000 skier visits but the base facilities as they exist now don’t reflect what people expect to see,” Toland said.