High-powered lawyer fights Katrina battle

MOSS POINT, Miss. — A private jet is waiting for Richard Scruggs, but first the millionaire lawyer wants to squeeze in a quick lunch. Smiles and nods greet him as he walks into Lu-Cher Doe’s Diner, a soul food restaurant down the street from his law office.

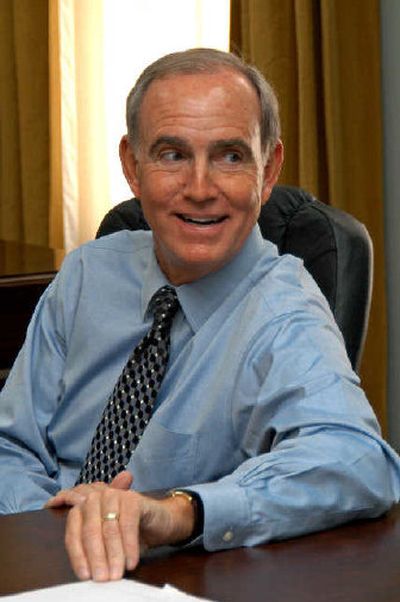

Everyone in the diner instantly recognizes the trim, gray-haired man in the expensive suit. Scruggs feels right at home, even though he sticks out in the crowd of T-shirt-wearing patrons seated at vinyl-covered tables.

Newsweek has called him possibly “the most influential man in America that you’ve never heard of,” but no introductions are needed here.

Scruggs, “Dickie” to his friends and neighbors, is one of the nation’s wealthiest trial attorneys. In the late 1990s, his Mississippi-based firm earned nearly $1 billion in fees for his part in reaching a landmark $250 billion settlement with tobacco companies.

Now he’s using that windfall to finance his latest high-profile legal battle — suing insurance companies for denying thousands of policyholders’ claims after Hurricane Katrina destroyed their homes.

Scruggs, already facing long odds in the eyes of some experts, recently lost a key ruling in one of his lawsuits. Despite that early setback, few legal handicappers are willing to count out someone with a track record of winning cases that nobody else could.

Many residents of southern Mississippi have turned to Scruggs for help since Katrina slammed into the Gulf Coast eight months ago.

It’s no different at the diner: After Scruggs finishes his meal, a waitress sidles up to his table and asks for his help in getting the Federal Emergency Management Agency to fix her trailer. Scruggs promises to draw up a strongly worded letter.

“I don’t know if it will do any good, but I’ll give ‘em hell,” says Scruggs, whose courtly manner has a way of softening his fiery rhetoric.

Less than an hour later, Scruggs is flying 20,000 feet above Mississippi in the cockpit of a Falcon 10 — one of two corporate jets the former Navy fighter pilot uses for his frequent 300-mile commutes from his home base in Oxford, Miss., to the coast.

The tobacco wars made Scruggs a very rich man, but his wealth also allows him to pick fights few other lawyers can afford. Besides insurance and tobacco companies, Scruggs has battled predatory lenders, asbestos makers and HMOs.

“You can’t take on State Farm and companies like that without a war chest,” says former Texas insurance commissioner J. Robert Hunter, director of insurance for the Consumer Federation of America.

“That’s one of the advantages of having a guy like Scruggs involved,” Hunter says. “He knows how to win big cases.”

Some in the insurance industry say Scruggs’ lawsuits are nothing more than an opportunistic money grab. Still, there’s no denying he has a personal stake in this battle: Like his clients, he lost one of his own homes in the hurricane.

“I’ve made enough money for 10 lifetimes,” says Scruggs, who turns 60 on May 17. “This is not a money thing for me. This is a personal thing. These are my friends, neighbors and family that are getting screwed, and I’m not going to sit still for it.”

One of his clients is his brother-in-law, U.S. Sen. Trent Lott, R-Miss., whose beachfront home in Pascagoula was demolished by Katrina. (The two men are married to sisters.) Lott is suing State Farm Insurance Co. for denying his claim.

“When he called me up and said, ‘Sue the bastards,’ I almost fell off my chair,” Scruggs says. “Trent and I are close personal friends, but we disagree obviously on most philosophical issues.”

Lott, a champion of limiting lawsuits, isn’t the only convert in this heavily Republican state. Katrina has turned some of Scruggs’ longtime adversaries into allies.

“He fights for the little guy, the guy who needs somebody,” said Mississippi’s first-term Attorney General Jim Hood, a Democrat who’s also suing insurance companies and investigating allegations they fraudulently denied claims.

“His heart is in this case,” Hood said of Scruggs. “These are his people.”

Scruggs is the self-described “poster child” for the wave of lawsuits spawned by the wind versus water debate on the Gulf Coast.

For thousands of homeowners without flood insurance, the critical question is whether damage was caused by Katrina’s 145 mph winds or by the wall of water that surged to shore. Wind damage is covered, but insurers say their policies do not cover damage from water, including wind-driven water. Policyholders argue that storm surge should not be considered flooding.

Mississippi’s top insurers have said their settlement rates, which reportedly ranged from 82 percent to 96 percent of claims six months after Katrina, prove they’re meeting obligations to policyholders. More than 1,500 other homeowners have signed up for a state-sponsored mediation program — an option Scruggs dismisses as a “joke.”

“The mediators have authority only up to a very small amount,” he says. “Many are taking the money out of desperation and out of being convinced they don’t have coverage.”

William Bailey, special counsel to the Insurance Information Institute, says Scruggs’ post-Katrina rhetoric is rife with “hyperbole” and “wildly overstated claims” that are virtually impossible for insurers to refute.

“I believe our people are honest and try to be fair,” Bailey said. “For someone to come in and try to paint us with a broad brush as a bunch of crooks and thieves, it just rankles me.”