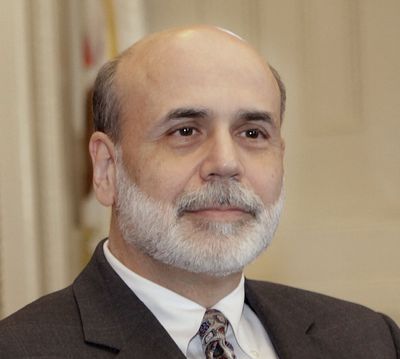

Bernanke to stay a second term

Cantwell voted ‘no’ in Senate confirmation

WASHINGTON – The Senate, putting market stability ahead of populist anger at Wall Street, voted Thursday to give Federal Reserve Chairman Ben Bernanke a second four-year term as head of the nation’s central bank.

The 70-30 vote was a hard-won victory for President Barack Obama, who had mounted an intensive lobbying campaign over the last week to sway rebellious senators who threatened to block the nomination of a Bush-era holdover whom they considered an emblem of failed economic policy.

The vote was bipartisan, but it was still the smallest vote margin for a Fed chairman in the central bank’s nearly century-long history, reflecting the intense public backlash in the wake of the worst economic crisis since the Great Depression.

Though he survived the politically charged debate on Capitol Hill, Bernanke faces tougher challenges as he embarks on his second term as head of an institution whose reputation has been tarnished in the past year.

For one thing, the congressional anger displayed in the run up to the vote may spell trouble as Bernanke tries to beat back efforts in Congress to increase transparency and oversight of the Fed and its activities, including the institution’s interest rate-setting monetary policy proceedings.

Bernanke has repeatedly argued that such legislation would threaten the independence of the Fed, subjecting it to potential undue political influence.

Senate Banking Committee Chairman Christopher Dodd, D-Conn., Thursday urged his colleagues to keep such policy questions at bay during the debate on Bernanke.

“If we need to reform the Fed, let’s reform the Fed,” Dodd said. But defeating Bernanke’s nomination would risk rocking the financial markets, Dodd said, and “would be beyond shameful. It would be the height of irresponsibility.”

Fed nominees are rarely controversial. Before Bernanke’s, the most-contested Fed nomination had been Paul Volcker’s 84-16 confirmation to a second term in 1983, after a deep recession.

Ever since Obama decided to re-nominate Bernanke, whose first term expires Sunday, critics have said that would signify a continuation of policies that had ruined the economy.

Democratic criticism became even sharper – and politically urgent – in the wake of the Republican victory in the Massachusetts special Senate election – an upset that many viewed as an expression of populist anger at Wall Street and Washington.

But critics of both parties criticized the chairman’s policies and handling of the financial crisis that prompted a massive federal bailout of financial institutions. Critics maintain that he and other federal regulators missed the warning signs of the impending credit crisis that surfaced near the end of 2008.

“By confirming Chairman Bernanke to a second term today, the Senate rubber-stamped a failed economic policy,” said Sen. Jim DeMint, D-S.C. “Chairman Bernanke’s easy-money policy fueled the housing bubble and his push for Wall Street bailouts made things worse.”

Beyond relations with Congress, Bernanke faces what is almost certain to be a highly contentious period for the Fed because of potential conflicts between its dual mandates – to maximize employment and also maintain price stability.

In the months ahead, if the economy grows as slowly as many economists expect, political pressure will mount for the Fed to keep the pedal on monetary stimulus to boost employment.

But if the Fed keeps the accelerator down too long, the result could be serious inflation in the long term. And Bernanke will face pressure from financial conservatives to begin tightening credit, which would tend to slow the economy.

It could be even more difficult for Bernanke and his colleagues to act independently if Congress expands its role in Fed affairs.

It will be all the more challenging for Bernanke because he has overseen a Fed that has more than doubled its assets since the worst of the financial crisis in the fall of 2008 by pumping billions into the economy.

The measures have helped to stabilize financial markets and avoid a more severe recession but they have left the central bank with the difficulty of keeping hundreds of billions of dollars now in reserves from entering the economy and adding to the dangers of inflation.