SBA agenda: Communicate, counsel, loan faster

Loans are the primary reason small businesses seek help from the Small Business Administration, but the new head of the agency says that more capital may not be what owners always need.

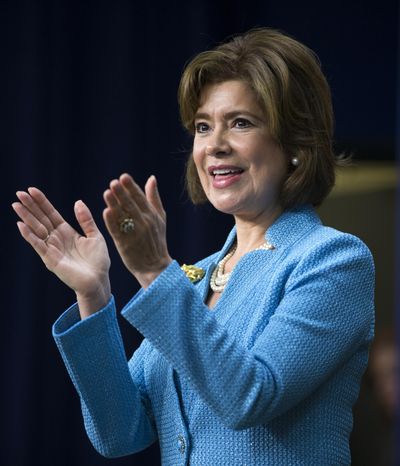

Maria Contreras-Sweet has been a small-business owner herself, most recently as co-founder of Promerica Bank, a Los Angeles-based lender focused on small companies. That experience not only helped her win the SBA post, it gives her insight into what could aid small companies the most.

“I think the counseling is almost more important than the lending. The lending is vital; we need access to capital for sure. But sometimes as I sat at the bank, business owners would ask me for a loan, and I’d say, you’re just not managing your cash well. Let’s talk about your cash flow, let’s talk about the business plan. Can I help you enough so you don’t need that extra line of credit?” she said in an interview this week with the Associated Press.

“And so many times, we’d give them a line of credit, and then it wasn’t deployed accurately or effectively or efficiently. I think our counseling programs can be key to our success.”

Two months into her tenure, Contreras-Sweet is still getting a handle on what’s working at the SBA and what needs to be changed. One area of focus is the way the agency communicates with small businesses. She’s recently launched a Twitter account to better connect with the public and says she’s also changing the way she’s taking in information.

And even though she thinks more counseling could be the key to helping owners be more successful, faster loan processing is also a priority. On Tuesday, she announced the SBA is giving banks what’s called a predictive business credit scoring model, a tool to help them forecast whether a borrower is likely to repay a loan. It’s designed to speed loan approvals.

Contreras-Sweet wants to know, are these programs working? She talked about her concerns, and her agenda, with the AP. Here are excerpts from the interview, edited for brevity and clarity:

Q. What have you found so far at the SBA that needs to be changed to help small businesses?

A. More Americans should be made aware about the opportunities SBA helps to create. And, how impressive it is that, at every key intersection of a businessperson’s cycle, the SBA has a response to their needs. I’m not certain that has been made abundantly clear to entrepreneurs. So I think first and foremost that’s something we want to focus on, how we communicate about the products, the services, the programs, that already exist.

Q. How do you do that?

A. We need to learn how to use all the media that’s available to us — the traditional, social media and informal ways of communicating. For example, instead of watching the evening news shows, I find younger people are watching shows like Jon Stewart’s “The Daily Show.” We need to understand where people are, how they’re getting information, and make sure we’re adapting to the new ways people are receiving information.

I’ve launched a Twitter account. I need to start opening up the way I communicate and the way I get information and the way I distribute information.

Q. What else is on your agenda for small business?

A. We’re conducting an external analysis about gaps in our programs that serve different segments of the population. For example, lending to African Americans. We’ve made a lot of progress, but we need to do more. Another example is our senior business owner population. We’ve seen economies where birth rates have fallen and as a result, their labor force is shrinking and they have challenges in maintaining their productivity per person. What can we do to anticipate that in the U.S.? At the SBA, we have a terrific Encore program for older entrepreneurs. My question is, is that sufficient?

Q. The SBA’s Office of Advocacy has issued a report about the government’s inability to reach its goal of giving contracts to small businesses. What can you do to improve that situation?

A. We are making sure through our counseling centers that we’re communicating the opportunities that are available. Our website, BusinessUSA, is important. Business owners can visit it and learn about what’s going on in the Agriculture Department, the Defense Department or the Department of Transportation. We’ve got to make sure those channels of communication are useful.

It’s also important to see if there are more industries we can target for contracts for women-owned businesses.

Q. How does being a Hispanic woman affect your approach to helping small-business owners?

A. It helps me ask, are our programs culturally competent? There are certain cultural nuances in the way we approach things. So do we have the cultural competency in our lending institutions? For example, in our institution, I’d hear from everyone about how important their privacy was. In some communities, people would say to me, I’m not very comfortable talking about money. We need to be respectful of cultural nuances to make sure we’re talking to people in a way that makes them comfortable.